Introduction to DRIPs: Starting Your Dividend Journey

Dive into the world of Dividend Reinvestment Plans (DRIPs) and discover how they can amplify your investment growth. Learn the essentials of DRIPs in our straightforward guide.

Dividend Reinvestment Plans (DRIPs) are investment strategies where dividends from a company’s stock are automatically reinvested to purchase more shares. This approach compounds returns over time, as the number of shares owned increases with each reinvestment, potentially leading to significant growth in the value of the investment. DRIPs are popular for their convenience and ability to leverage the power of compounding, especially for long-term investors seeking steady growth.

What Are DRIPs?

Dividend Reinvestment Plans, commonly known as DRIPs, are a tool in the arsenal of an investor looking to grow their holdings in a company over time.

When a company pays out dividends to its shareholders, typically in the form of cash, a DRIP allows these funds to be automatically reinvested to purchase more stock in the same company.

Here’s a simplified breakdown of the process:

- An investor owns shares in a company.

- The company distributes dividends to its shareholders.

- Rather than receiving the dividend in cash, it automatically purchases additional shares.

There are mainly two types of DRIPs offered:

- Full DRIP:

- All dividends received are automatically reinvested.

- Partial DRIP:

- Investors choose to reinvest a portion of their dividends.

As financial advisors, we’ve seen clients benefit from enrolling in DRIPs due to the power of compounding. Investing in a DRIP can be a strategic move, especially if you believe in the long-term prospect of the company and seek to increase your investment without additional funds.

One of our clients started with a modest investment in a blue-chip company’s DRIP. Over a decade, without adding more money from her pocket, her initial investment tripled, showcasing the compounding effect of DRIPs.

Adopting a DRIP means you’re committed to a long-term investment strategy. It’s wise to consider your financial goals, risk appetite, and the specific terms of the DRIP before participation.

Not all companies offer DRIPs, and the specifics can vary, including potential transaction fees and the option for a discount on reinvested shares. We advise evaluating whether such a program aligns with your broader investment strategy.

Types of DRIPs

When considering investment in DRIPs—Dividend Reinvestment Plans—we must carefully examine the different types that cater to various investment strategies and preferences.

Each type has its unique characteristics and benefits that align with specific investor needs.

Company-Operated DRIPs

Company-operated DRIPs are facilitated directly by the corporation issuing the stock. In our experience, these DRIPs often offer the added benefit of purchasing additional shares at a discounted price, without any brokerage fees.

This type of plan can be ideal for individuals who prefer to invest directly with the company in question and wish to take advantage of potential discounts and savings on transaction costs.

Brokerage DRIPs

Brokerage DRIPs are managed through a broker, and they provide the convenience of consolidating various dividend-reinvesting options under one account. Many investors we’ve advised appreciate the ease of managing their dividends through a familiar platform, especially when they already have other investments with the same broker.

They often provide automatic reinvestment of dividends into additional shares of the dividend-paying stock but may come with fees associated with the brokerage service.

Direct Stock Purchase Plans

Direct Stock Purchase Plans (DSPPs) are similar to company-operated DRIPs but enable investors to buy stock directly from the company without going through a broker.

A client of ours benefitted significantly from this approach due to lower costs and the avoidance of broker fees. DSPPs can also come with minimum investment requirements and may offer optional cash payments to purchase additional shares.

Third-Party DRIPs

Third-Party DRIPs are managed by entities other than the issuing company or a brokerage firm. These can provide services like record-keeping and administration of the DRIP for multiple companies.

However, keep in mind that there could be administrative fees to consider. An investor should assess whether the convenience of consolidating various DRIPs with a single third-party outweighs the potential costs.

Enrollment and Participation

Before you embark on the journey of reinvesting dividends through a Dividend Reinvestment Plan (DRIP), it’s important to be aware of the criteria for enrollment, which can differ depending on the company, and understand the role of transfer agents in the process.

By fulfilling eligibility and requirements and adhering to the enrollment process, shareholders pave their way towards potentially enhanced investment growth.

Eligibility and Requirements

To participate in a DRIP, investors must first ensure they meet the specific eligibility criteria set by the offering company.

Typically, you must already be a shareholder of the company with at least one share in your name.

Some plans might allow immediate enrollment upon purchasing shares, whereas others may have stipulations such as holding the shares for a certain period.

Enrollment Process

Once you’ve determined your eligibility, the next step is to enroll in the DRIP. Enrollment can often be completed online through the company’s website or by mailing a completed enrollment form.

In our experience, enrolling online is generally more efficient and allows for quicker confirmation of participation.

Transfer Agents and Their Role

Transfer agents play a crucial role in managing DRIPs. They are responsible for keeping track of all shareholder records, issuing stock certificates, and processing transactions involved in the plan.

When you enroll in a DRIP, it’s the transfer agent you’ll interact with for most administrative issues regarding your investment.

Financial Considerations

In exploring Dividend Reinvestment Plans (DRIPs), it’s crucial we understand the financial aspects involved, particularly regarding costs and tax implications.

These factors can influence our investment growth and should be factored into our decision-making process.

Costs and Fees

DRIPs often boast the advantage of lower transaction fees as compared to traditional stock purchase methods. While many plans allow us to reinvest dividends without any fees, we must be vigilant, as some do charge for this service.

It’s imperative to scrutinize the details of each DRIP, as fees can erode our investment’s compounding potential. Moreover, when we decide to sell shares acquired through DRIPs, we may be subject to transaction fees at that point.

The cost structure varies per plan, so confirming these details directly impacts our investment efficiency.

Tax Implications

Dividends reinvested through DRIPs don’t escape the taxman’s notice; they’re still considered taxable income. This can sometimes surprise investors who assume reinvested dividends aren’t subject to taxation.

Each year, we’ll receive a statement indicating the amount to be reported on our tax return. It’s also worth noting that keeping track of the cost basis for each purchase can become complex, but it’s essential for accurately reporting capital gains when we sell the shares.

Taxation laws and regulations can be intricate, and they may differ based on individual circumstances and jurisdictions.

It could be easy for someone to overlook reporting reinvested dividends as taxable income, resulting in an unexpected tax bill. It’s an easy mistake to make, so we always emphasize the importance of accurate record-keeping.

Investment Strategy and Benefits

When discussing Dividend Reinvestment Plans (DRIPs), we’re examining a powerful strategy that enhances our portfolio through dollar-cost averaging, compounding and growth, and diversification.

These mechanisms work in tandem to potentially increase the value of our investment over time, while offering a systematic approach to investing.

Dollar-Cost Averaging

By reinvesting dividends to purchase additional shares, DRIPs naturally employ dollar-cost averaging.

This technique involves consistently acquiring more shares of a stock or fund at regular intervals, regardless of the share price.

We benefit from this approach as we purchase more shares when prices are low and fewer when prices are high, possibly reducing the overall cost per share over time.

Compounding and Growth

The magic of compounding lies in the ability to generate earnings on our reinvested dividends, fostering a cycle of growth where our gains generate their own gains.

This effect magnifies over time, potentially boosting the total compounding returns of our portfolio significantly. Using DRIPs to reinvest dividends effectively harnesses this power, turning small, periodic investments into considerable wealth over the long term.

Diversification

Diversification is a fundamental investment principle aimed at spreading exposure to reduce risk.

With DRIPs, as we reinvest dividends across different stocks or sectors, we’re enhancing the diversification of our portfolio. This tactic can potentially protect us against the impact of poor performance in any single investment or sector.

In my years of advising, I’ve seen many investors benefit from the diversified portfolios constructed through disciplined reinvestment practices. DRIPs contributed to this by systematically adding varied holdings, reinforcing their portfolio against market dips.

Managing a DRIP Portfolio

When it comes to managing a DRIP portfolio, it’s essential to have systems in place for tracking your investments, knowing when and how to buy additional shares, as well as understanding the process for selling shares should you need to liquidate your assets.

Portfolio Tracking

We must keep a meticulous record of our investments to monitor our portfolio’s performance accurately. This can be achieved through spreadsheet software or a specialized investment tracking application.

We’ll want to record each dividend payment and the shares purchased through our Dividend Reinvestment Plans (DRIPs).

It is crucial to note the price at which new shares are acquired, which is often at or near the current market price. This data helps us assess our investment’s growth over time.

Example Record:

| Date | Dividend Rec’d | Share Price | Shares Added |

|---|---|---|---|

| 2023-03-01 | $50 | $25 | 2 |

As we track our portfolio, we often discover patterns in our dividend income, enabling us to make informed decisions about future investments.

Buying Additional Shares

Adding to our portfolio through an optional cash purchase can bolster our position. Most DRIPs and stock purchase plans give us the ability to purchase additional shares directly, often without commission or at a reduced cost.

This is particularly advantageous when the market price is favorable. It’s important to adhere to the plan’s minimum and maximum investment limits, which are put in place to ensure both accessibility for new investors and prevent over-concentration.

I remember when the market fell after the announcement the US had gone to war in Iraq. My assumption was this war would pass in time, and the sell-off was a knee-jerk reaction to the news. As a result, I utilized an optional cash purchase to capitalize on the market dip, acquiring additional shares at a lower price and effectively reducing my average cost basis.

Selling Shares

Although DRIPs are typically used for long-term investing, there might be occasions when we need to sell shares. The process for selling shares can vary between DRIPs, so it’s important to review the specific terms of the plan.

Some plans may offer an automatic sale option at the prevailing market price, while others require that we notify the plan administrator of our intent to sell. Keep in mind that when shares are sold, capital gains taxes will apply, so it’s wise to consult with a tax advisor.

DRIPs and Retirement Planning

Investing in a Dividend Reinvestment Plan (DRIP) can be a strategic component of your retirement planning.

As financial advisors, we often stress the importance of diversification and long-term investing, both of which are critical considerations for a robust retirement portfolio.

DRIPs allow investors to automatically reinvest dividends to purchase more shares of the stock, often without any transaction fees.

This can potentially lead to accelerated portfolio growth over time, tapping into the power of compound interest.

Here is what diversification within your portfolio might look like with DRIPs:

- Equities: 60%

- Bonds: 30%

- Others (Real Estate, etc.): 10%

- DRIP-enabled Stocks: Included in Equities

Remember, a well-diversified portfolio can reduce risk.

Our approach to long-term investing includes evaluating companies that have a consistent track record of paying dividends.

Investing in such companies through DRIPs can effectively turn the dividends into additional equity, which may lead to increased value over the years.

It is also essential to review your portfolio periodically to ensure that it aligns with your retirement objectives.

While it’s tempting to “set and forget,” regular reviews with your financial advisor can ensure that your investments remain in tandem with your evolving financial goals and market conditions.

Common DRIP Features

In our experience aiding clients with long-term investment strategies, we’ve found dividend reinvestment plans (DRIPs) to be a cornerstone for building wealth through compounding.

These plans often come with several enticing features that can appeal to a wide range of investors, from those just starting to build their portfolios to seasoned investors looking to maximize their dividend income.

Automatic Dividend Reinvestment

The cornerstone of DRIPs is the automatic reinvestment of cash dividends into additional shares or fractional shares of the underlying stock.

This occurs on a quarterly or monthly basis, without the need for the investor’s direct involvement. By doing so, you’re taking advantage of compounding, as your dividend income is used to increase your shareholdings over time.

In my early days of investing, I vividly remember the excitement of watching my first few shares grow incrementally without lifting a finger, all thanks to automatic reinvestment.

Optional Cash Purchase Plans

Many DRIPs offer optional cash purchase (OCP) plans allowing investors to buy additional shares directly through the company, typically with minimal or no brokerage fees.

Our clients appreciate this method as it enables them to increase their investment on a regular basis with cash dividends or additional funds.

Discounted Purchases

Some DRIPs incentivize investors by offering the chance to purchase additional shares at a discounted price.

This discount can range from 1% to 10%, making it a cost-effective way to grow your investments.

Investing in a DRIP with a discounted purchase option is akin to buying dollar bills for ninety cents; it’s a value difficult to ignore.

Dividend Payment Options

Investors often have the choice in how they receive dividend payments. While many opt for the convenience of automatic reinvestment, some prefer receiving cash dividends.

This flexibility allows for personal cash flow management while still participating in the growth potential of the underlying investment.

Our firm prides itself on guiding clients through the nuances of these plans and identifying which DRIP features align best with their investment goals.

Whether it’s leveraging automatic dividend reinvestment to capitalize on compounding or utilizing optional cash purchase plans to increase market position steadily, we make certain that our clients are adept at using these tools to their advantage.

Risks and Drawbacks

While Dividend Reinvestment Plans (DRIPs) are a popular investment strategy, it’s essential for us to consider their potential risks and drawbacks. These can impact our long-term investment goals and liquidity needs.

Market Risk

Market risk refers to the possible losses we may face due to fluctuations in stock market prices.

Since DRIPs involve the automatic reinvestment of dividends into more shares of stock, we increase our exposure to the volatility of the market.

It’s akin to a situation where we’re consistently buying more pieces of a ship in the hopes it will reach a golden shore, yet the sea remains unpredictable.

For instance, if the company we’ve invested in faces a downturn, our reinvested dividends buy shares that may decrease in value.

Lack of Liquidity

Lack of liquidity is another drawback to consider. By automatically reinvesting dividends, our funds are tied up in additional shares rather than being available as cash. This can be problematic if we need quick access to funds.

Fees and Costs

Lastly, we must be aware of the fees and costs associated with DRIPs. While many plans offer commission-free purchases, some may still include fees that could erode the benefits of the strategy over time.

Additionally, we must consider the tax implications of reinvested dividends as they are typically treated as taxable income.

DRIPs in Different Sectors

Investment strategies such as Dividend Reinvestment Plans (DRIPs) can be applied across different sectors, allowing for sector-specific growth and potential advantages. Here’s how DRIPs function in various sectors:

Real Estate Investment Trusts (REITs)

Real estate investment trusts, or REITs, are popular for their often robust dividend yields. We have found that reinvesting these dividends through DRIPs can lead to significant compound growth over time. It’s a way to increase your stake in property markets without purchasing additional property.

- Example: Assume a REIT offers a 5% annual dividend yield. By reinvesting those dividends, an investor could, in effect, buy more shares of the REIT, increasing potential future dividends and one’s share of the assets.

Master Limited Partnerships

Master Limited Partnerships (MLPs) are known for their distributions, which can be akin to high-yield dividends. DRIPs within MLPs facilitate the purchase of additional partnership units.

- Key Consideration: Tax implications. MLPs can have complicated tax consequences; thus, when using DRIPs, consulting with a tax advisor is essential.

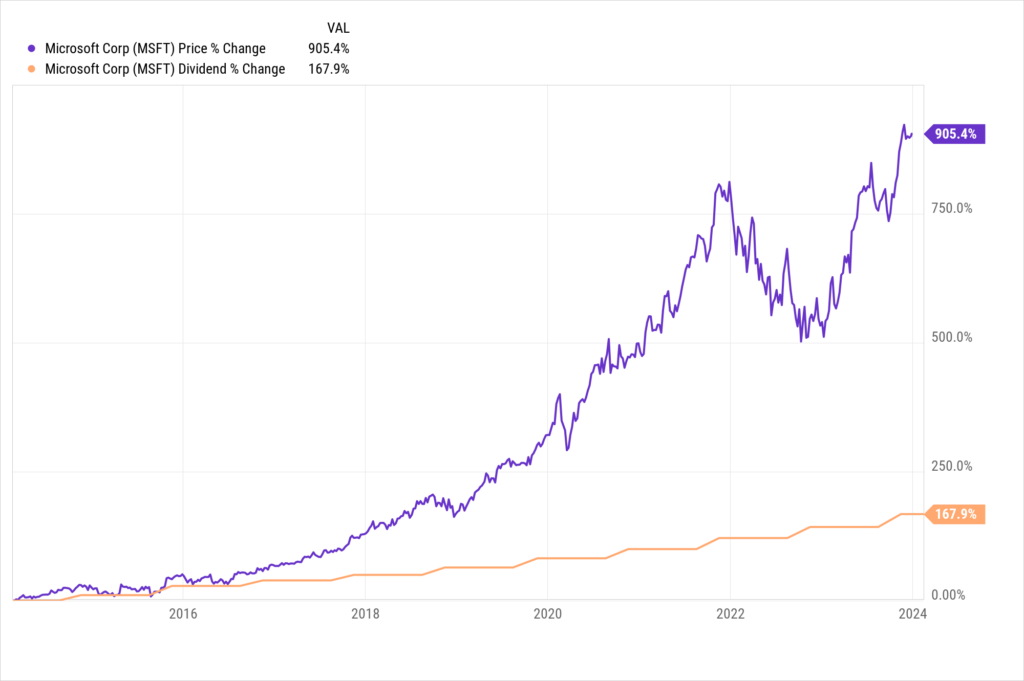

Technology Companies

While not all technology companies pay dividends, those like Microsoft (MSFT) can offer a growth and income combination. By enrolling in DRIPs, you can potentially gain more shares of these innovative companies.

- Benefit: Accumulating more shares of tech companies through DRIPs could mean benefiting from their exponential growth while being a part of the technological advancements they drive.

Consumer Goods Companies

Companies such as PepsiCo (PEP) offer stable dividends, making them ideal candidates for DRIPs. Consumer goods companies are less volatile and provide a steady stream of dividends, which can be reinvested to acquire more shares.

- Stability: Reinvesting dividends from these companies traditionally offers a more predictable growth path for investors’ portfolios due to the essential nature of the goods provided.

By carefully selecting which DRIPs to participate in, we can optimize our investment strategy to suit our risk tolerance and financial goals, ensuring a diversified and growth-oriented portfolio.

Advanced DRIP Topics

In this section, we delve into the nuances of Dividend Reinvestment Plans (DRIPs) that can have a significant impact on our investment strategies, focusing on fractional shares, tax implications, and the importance of understanding dividend dates.

Fractional Shares and Their Impact

Fractional shares are an essential component of DRIPs, allowing us to reinvest dividends into partial shares of stock.

This strategy enables us to maximize the power of compounding by purchasing shares up to the penny of the dividend paid, rather than buying whole shares.

In my early investing days, I remember how fractional shares in a DRIP program helped me to steadily grow my holdings in a premier blue-chip company despite having limited funds.

Tax Reporting

When it comes to tax reporting, DRIPs do not receive special treatment. We must report dividends reinvested through DRIPs on our Form 1099-DIV.

This form will differentiate between qualified dividends, which are taxed at more favorable rates, and non-qualified dividends, which are taxed at our ordinary income tax rate.

Keeping accurate records is crucial as each reinvestment increases our cost basis in the stock, which matters when we sell shares.

Understanding Dividend Dates

To make informed decisions about our DRIPs, we must understand dividend dates, including the declaration date, ex-dividend date, record date, and payment date.

The ex-dividend date determines our eligibility to receive the next dividend; to be entitled, we must hold the stock before this date.

The record date is when the company reviews its records to determine shareholders’ eligibility, and the payment date is when the dividend is paid.

Recommended Reading on DRIPs

- Introduction to DRIPs

- Pros and Cons of DRIPs

- How to Start a DRIP

- Best Stocks for DRIPs

- DRIPs vs. Direct Stock Purchase

- Tax Implications of DRIPs

- DRIPs in Retirement Planning

- DRIPs in High Dividend Yield Stocks

- Balancing DRIPs with Other Investment Strategies

- Adjusting DRIP Investments

- DRIPs in Different Economic Cycles