Understanding Dividend Payout Ratios: A Guide to Shareholder Returns

Demystify the key aspects of Dividend Payout Ratios with our concise guide. Learn how this crucial metric shapes your investment decisions and stock evaluations.

Understanding Dividend Payout Ratios involves comprehending how much of a company’s earnings are paid to shareholders as dividends. This ratio, calculated by dividing the annual dividends per share by the earnings per share, indicates a company’s ability to sustain its dividend payments. A lower ratio suggests potential for growth and reinvestment in the business, while a higher ratio might signal a mature company with fewer growth opportunities. Analyzing this ratio helps investors gauge a stock’s income-generating potential and financial stability.

Dividend Payout Ratios Explained

When we discuss dividend payout ratios, we are looking at how a company’s earnings are utilized to reward shareholders. The dividend payout ratio is essentially the fraction of a company’s earnings paid out as dividends to shareholders, typically represented as a percentage.

The Dividend Payout Ratio is calculated using the following formula:

Dividend Payout Ratio=Total Dividends Paid/Net Income

Alternatively, it can also be expressed on a per share basis:

Dividend Payout Ratio=Dividends Per Share (DPS)/Earnings Per Share (EPS)

Here’s how to use the formula:

- Total Dividends Paid: This is the total amount of dividends paid out by a company in a year.

- Net Income: This is the total profit of the company after all expenses and taxes have been deducted.

- Dividends Per Share (DPS): This is the total dividends paid divided by the number of outstanding shares.

- Earnings Per Share (EPS): This is the company’s net income divided by the number of outstanding shares.

By dividing the total dividends paid (or DPS) by the net income (or EPS), you get the Dividend Payout Ratio, which tells you the percentage of earnings a company is paying out as dividends to its shareholders.

This ratio tells us how much income is being returned to shareholders compared to the amount retained by the company for growth.

A lower ratio often suggests future growth, while a higher ratio may indicate the company is willing to return more profits to its investors.

Through my years as a stock investor, I’ve seen diverse strategies around dividend payout ratios. Some investors prioritize high payout ratios, associating them with stable income. Others opt for lower payout ratios, which might signal reinvestment and potential for growth.

It is essential to understand that a ratio that is either too high or too low may carry implications. A ratio above 100% could be unsustainable in the long term, whereas a very low ratio could suggest a company is either hoarding cash or investing heavily in its future – each scenario requires a different kind of consideration from us as investors.

When you look at Investopedia, there’s a wealth of information confirming these insights. And when assessing the sustainability of a dividend, it’s the payout ratio that often provides a clear image of the company’s intentions.

In our investment journey, let us grade each ratio with context, analyzing company strategy and industry standards to make informed decisions.

Importance of Dividend Payout Ratios

Understanding dividend payout ratios is crucial for us as investors since it influences both our investment strategy and perception of a company’s financial health. It’s the bridge between corporate profits and our potential returns.

Investor Decision-Making

The dividend payout ratio is an indicator we leverage to gauge if a company aligns with our investment goals.

For instance, if we are looking for income-generating investments, a higher payout ratio suggests that a company returns a significant portion of its earnings to shareholders as dividends.

Conversely, a lower payout ratio might imply the company is reinvesting profits into growth initiatives, which could lead to capital appreciation over time.

Many investors like using the payout ratio because it is easy to understand when selecting dividend stocks to add to their portfolio.

Company Financial Health

Analyzing the dividend payout ratio also helps us assess a company’s financial stability and long-term viability.

A ratio that is too high can signal potential danger, especially if earnings are volatile; a company might struggle to maintain its dividend payments during downturns.

Conversely, a sustainable payout ratio generally indicates a stable profit stream and, by extension, a potentially reliable dividend.

I’ve observed companies with modest payout ratios weather economic storms much better, providing us with a sense of security in our investment choices even during uncertain times.

Calculating Dividend Payout Ratio

Assessing the dividend payout ratio is essential for us as investors to understand the portion of a company’s earnings allocated to dividends, providing insight into its dividend sustainability and growth potential.

Basic Formula

The dividend payout ratio is a straightforward calculation we use to determine how much of a company’s earnings are paid out to shareholders in the form of dividends. The basic formula for the dividend payout ratio (DPR) is:

- DPR = Total Dividends Paid / Net Income

To elaborate, if a company has net earnings of $1,000,000 and pays out $300,000 in dividends, its dividend payout ratio would be:

- DPR = $300,000 / $1,000,000

- DPR = 0.3 or 30%

This 30% figure means that the company returns 30% of its net income to shareholders as dividends.

Variations and Adjustments

While the basic formula serves as a solid foundation, there are variations and adjustments that can provide a more nuanced picture of a company’s dividend distribution policy.

- DPR adjusted for preferred dividends:

- DPR = (Total Dividends Paid – Preferred Dividends) / Net Income

Preferred dividends must be subtracted from total dividends because they are not available to common shareholders, which can affect the ratio significantly.

- Using earnings per share (EPS) and dividends per share (DPS):

- DPR = Dividends per Share / Earnings per Share

This is beneficial when analyzing the dividend payout on a per-share basis, which is often how we encounter dividends as individual investors.

Analysts may also consider a trailing DPR, which uses the past 12 months of dividends and earnings, or a forward DPR, which forecasts future payouts.

A personal observation: Throughout my investing journey, I’ve noticed that well-established companies often aim for a consistent dividend payout ratio, signaling a steady approach to returning value to shareholders.

In our practice, we must always keep in mind these variations because they can impact the interpretation of a company’s payout policies and its commitment to shareholder returns.

Factors Influencing Dividend Payout Ratios

Dividend payout ratios can be indicative of a company’s financial health and its management’s perspective on growth and shareholder value.

Key factors such as where a company stands in its lifecycle and the norms within its industry play substantial roles.

Business Lifecycle Stage

In the early growth stages, companies often retain more income for reinvestment to fuel future expansion.

We typically observe lower or non-existent dividend payouts during this phase. In contrast, mature companies usually have stabilized earnings and might issue higher dividends, reflecting lower reinvestment requirements.

For instance, years ago when our portfolio included emerging tech companies, we saw minimal dividends, which was logical given their growth ambitions.

Industry Standards

Industry norms also shape dividend payouts. Sectors with consistent cash flows—like utilities or consumer goods—often have higher payout ratios, as these industries are less capital-intensive and can afford to distribute a larger share of profits to shareholders.

On the other hand, sectors that are highly cyclical or require significant capital outlay—such as construction or technology— commonly showcase lower payout ratios, reinvesting profits into new projects and R&D.

Our experience with utility stocks has shown that stable dividends are the norm, which aligns with the predictable nature of their cash flows.

Interpreting Dividend Payout Ratios

When we analyze the financial health and shareholder reward system of a company, dividend payout ratios serve as a pivotal metric.

This ratio helps us gauge whether earnings are being used to pay dividends or reinvest in the company, with critical implications for both scenarios.

High Payout Ratio Implications

A high dividend payout ratio indicates a company is returning a large portion of its net income to its shareholders as dividends.

While this can be appealing to income-focused investors, it can also suggest that the company has limited opportunities for growth or that it’s in a mature stage of its business cycle.

On the other hand, consistently high payout ratios may strain the company’s finances, potentially indicating a future dividend cut if earnings fall.

Low Payout Ratio Implications

Conversely, a low dividend payout ratio generally means that a company is reinvesting a significant portion of its profits back into the business.

This can be a sign of a growth-oriented company with potential for capital gains. However, for dividend-seeking investors, a low payout might be less attractive due to the smaller income stream.

Dividend Payout Ratios vs. Other Financial Metrics

In evaluating the financial health and shareholder rewards of a company, we often compare the dividend payout ratio to other financial metrics.

These comparisons provide us with a comprehensive view of a company’s financial strategy and its implications for shareholder value.

Dividend Yield Comparison

When we talk about dividend yield, we’re looking at the annual dividends paid out by a company relative to its stock price.

Unlike the dividend payout ratio, which tells us what percentage of earnings is distributed as dividends, the dividend yield gives us an immediate understanding of the return on investment from dividends alone.

It’s essential to note that a high dividend yield doesn’t automatically indicate a better investment; sometimes, it could signal a company in distress with a declining stock price.

In our experience, a mature company with a modest yield but a stable payout ratio often suggests a safer bet for consistent income.

Retention Ratio Relationship

Conversely, the retention ratio reveals the opposite of the payout ratio: the percentage of net income retained in the company for growth.

Companies with high retention ratios are typically in growth or repair mode, investing profits back into the business rather than paying them out as dividends.

Understanding the balance between these ratios helps us gauge a company’s long-term strategy: paying dividends for current shareholder returns versus retaining earnings for future growth. For investors seeking growth, a company with a high retention ratio may be more appealing.

I recall a burgeoning tech firm we invested in, which boasted a soaring retention ratio; this signaled their commitment to reinvesting and served as a harbinger for impressive capital gains.

Challenges and Limitations of Dividend Payout Ratios

Dividend payout ratios are a tool we often rely on to judge the sustainability of a company’s dividend payments in relation to its earnings. Yet, they are not without their challenges and shortcomings that can affect our investment decisions.

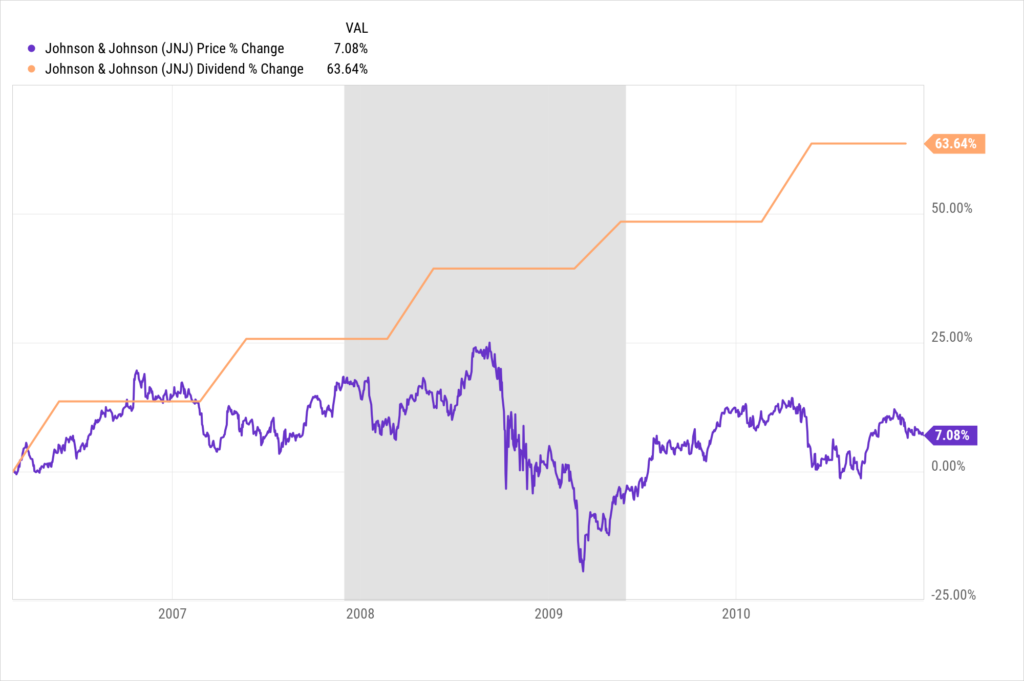

Earnings Volatility Impact

Earnings volatility can significantly skew the dividend payout ratio, leading to an imperfect representation of a company’s payout sustainability.

For companies with fluctuating profits, a single period’s payout ratio might not accurately reflect the long-term ability to maintain dividends.

External Economic Factors

Economic shifts that impact industry performance don’t always sync with dividend payout ratios.

For instance, a broad economic downturn can depress earnings across a sector, artificially elevating payout ratios and painting a misleading picture of dividend risk.

During the 2008 financial crisis, many of our held stocks saw their payout ratios climb, not due to dividend changes but because of the extensive impact on earnings.

Growth and Investment Balance

Finding the right balance between paying dividends and reinvesting in our company is crucial. In the early days of our investment career, we reinvested heavily to fuel growth, knowing it would lead to a more robust dividend in the future.

- Prioritizing investments in profitable projects over dividends when it leads to higher long-term returns.

- Reducing payout ratios temporarily during expansion phases to ensure sufficient capital.

- Incrementally increasing dividends as profits and cash flows grow over time.

Case Studies and Historical Trends

In examining dividend payout ratios, we must consider real-world scenarios and how dividend strategies have evolved over time.

Now let’s dig into specific case studies and track the historical changes in payout strategies.

Impact of Market Conditions

Market conditions significantly affect dividend payout ratios. For example, during periods of economic downturn, companies might reduce dividend payouts to conserve cash. Conversely, in a robust economy, firms often increase dividends, leveraging their strong financial performance.

In the dot-com bubble burst of the early 2000s, we observed a trend among tech companies to withhold dividends, guarding their cash reserves diligently. As an investor enamored by the Silicon Valley promise, this strategic prudence was a bitter pill to swallow, yet one that taught the importance of fiscal agility.

Evolution of Payout Strategies

Over the decades, we’ve witnessed an evolution in dividend payout strategies. Initially, mature businesses with stable cash flows traditionally offered higher dividends. However, there has been a shift where even growth-oriented firms now pay dividends to appeal to a broader investor base.

Recall the mid-2010s, when a renowned consumer electronics company initiated dividend payouts after years of reinvesting earnings. Our portfolio welcomed this change as a move toward a shareholder-friendly approach, balancing growth potential with a steady income stream.

Future Outlook and Predictions

In the dynamic world of investing, understanding the dividend payout ratio’s future outlook hinges on factors such as technological advancements and regulatory landscapes. We’ll examine how these elements may shape our predictions for dividend distribution strategies.

Technological Advancements Influence

The role of technological advancements cannot be overstated when predicting the future of dividend payout ratios.

We have seen how automation and AI have streamlined operations, potentially leading to higher profitability and, by extension, more generous dividend payouts.

For instance, the adoption of cloud computing in our company’s operations significantly cut down costs and boosted our profit margins, hinting at a favorable future for our dividend distributions.

Regulatory Environment Effects

Regulatory changes often have direct implications on a company’s financial health and its capacity to pay dividends. For example, new tax regulations can influence corporate earnings—a topic we must monitor closely.

Stricter environmental laws might increase operational costs for certain sectors, potentially affecting their respective payout ratios.

We’ve observed this in the energy sector, where regulatory pressures have prompted a reshuffling of capital allocation, impacting dividend policies.

Related Reading on Dividend Payout Ratios

- Understanding Dividend Payout Ratios

- Ideal Payout Ratios for Stability

- Payout Ratios in Different Sectors

- High Payout Ratios: Pros and Cons

- Calculating Dividend Payout Ratios

- Payout Ratios and Company Growth

- Historical Trends in Payout Ratios

- Dividend Cuts and Payout Ratios

- Payout Ratios and Stock Valuations

- Global Comparison of Payout Ratios