Secrets of Dividend Aristocrats Revealed!

In the investment landscape, dividend aristocrats stand out as a beacon for consistency and reliability. These prestigious members of the stock market have a history of increasing their dividends for at least 25 consecutive years. What sets these companies apart is not just their longevity but their ability to endure through economic cycles, offering a semblance of security in an often volatile market. For us as financial advisors, these stocks represent a cornerstone for clients looking to build a steady income stream alongside capital appreciation.

The dividend yield on these stocks can be particularly attractive to investors in our age bracket, catering to the desire for both growth and income. When we analyze dividend aristocrats, we’re examining firms that are typically well-established with durable business models—a characteristic that may bring peace of mind to investors who seek stability in their portfolios. It’s like having a bedrock underneath your investment strategy, one that we’ve seen provide continuous support during turbulent times.

Key Takeaways

- Dividend aristocrats are time-tested stocks with a track record of increasing dividends for 25 or more years.

- These stocks offer potential stability and could be included in a diversified dividend investment strategy.

- It is important to consider financial metrics and economic factors when evaluating dividend aristocrats.

Defining Dividend Aristocrats

In our examination of standout performers in the stock market, Dividend Aristocrats stand apart as a testament to reliability and stability. These stocks have a track record of consistent dividend growth, appealing to investors who value predictable and growing income streams.

Qualification Criteria

To be recognized as a Dividend Aristocrat, a company must meet several strict criteria. A stock must be part of the S&P 500 index, ensuring that it is one of the leading companies in the U.S by market capitalization.

More importantly, it must have increased its dividend payouts for at least 25 consecutive years. This shows not just an ability to pay dividends, but a commitment to regularly increasing them, which in turn indicates underlying financial health and management’s confidence in the company’s future.

Historical Context

The concept of Dividend Aristocrats is grounded in historical performance data that suggests dividends are a significant component of long-term stock returns.

Many of these companies belong to sectors like consumer staples, which tend to be less volatile and more resistant to economic downturns.

When we look back through economic cycles, Dividend Aristocrat stocks have provided shareholders with consistent income alongside capital appreciation.

Dividend Aristocrats vs. Dividend Kings

Dividend Aristocrats should not be confused with Dividend Kings, a more exclusive group.

For a company to be considered a Dividend King, it must have a history of increasing dividends for at least 50 years. While all Dividend Kings are certainly Aristocrats due to their longer streaks, not all Aristocrats achieve the revered status of a King.

Regardless, both groups represent the pinnacle of dividend reliability, and as such, they are often core holdings in the portfolios of income-focused investors.

Benefits of Investing in Dividend Aristocrats

Dividend Aristocrats are the epitome of steady performance and resilience in the financial world, with their strong track records in providing reliable income and demonstrating growth.

Stable Income Stream

One of the primary advantages of Dividend Aristocrats is their ability to provide investors with a consistent and predictable income stream.

These companies have a history of increasing dividends for at least 25 consecutive years, reflecting their commitment to returning value to shareholders.

I saw the power of dividend income and growth in my investment practice on a daily basis. Even during the Great Recession of 2007-2009, many (if not most) Dividend Aristocrats continued to increase their dividend payouts.

This allowed retirees who were harvesting their dividends for income to experience a pay raise even though the stock prices and principal investments were down with the market decline.

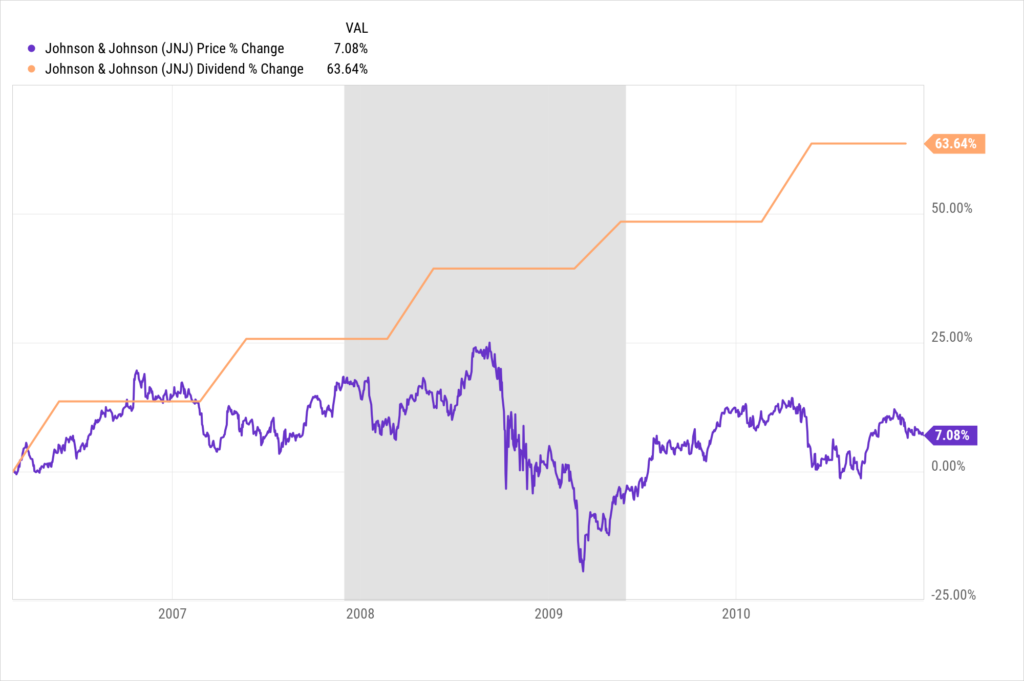

As an example, here is a chart of Johnson and Johnson (JNJ) between 2006 and 2010. Notice how the stock price went up and down, but only gained 7% over 4 years. However, the dividend grew by 63.64% over the same time period.

What else is impressive is the area shaded gray represents a time when the US economy was in a recession, and yet JNJ investors saw their dividend income go up twice during the recession (once in 2008 and again in 2009).

Price Appreciation

In addition to the income they provide, Dividend Aristocrats often exhibit price appreciation over time.

This aspect of capital gains complements the dividend income, contributing to the total return for investors. Share prices tend to be supported by the solid underlying business fundamentals that enable consistent dividend growth.

Recession Performance

When markets face downturns, Dividend Aristocrats are typically more resilient, which can be a comforting factor for investors concerned about performance during recessions.

Their stability and established market presence often shield them from the full brunt of economic swings. During the 2008 financial crisis, we saw many of these stocks outperforming the broader market, providing a relative safe haven for our client’s investments.

By focusing on such financially sound and fundamentally strong companies, we place ourselves in a position to benefit from steady dividends, potential for capital appreciation, and a potential buffer against market volatility, particularly during economic contractions.

Analyzing Dividend Aristocrat Funds

When we investigate Dividend Aristocrat funds, we’re looking at a class of exchange-traded funds (ETFs) that specifically target companies with a history of increasing dividends.

In my experience, these funds can offer a blend of potential growth and income stability.

When using an ETF as an investment vehicle, you are gaining access to potentially hundreds of individual companies, which may offer a bit of “safety in numbers” type of approach.

Exchange-Traded Funds (ETFs)

Dividend Aristocrat ETFs have grown popular among investors seeking steady dividend income combined with the potential for capital appreciation.

These funds track indices of companies that have a record of consistently increasing their dividends for a number of years.

Investable products like ETFs provide exposure to a diversified portfolio of these dividend-growing companies, which can be more efficient than purchasing individual stocks.

NOBL – The ProShares S&P 500 Dividend Aristocrats ETF

Chart: Hypothetical $10,000 Invested in NOBL over the last 10 years.

NOBL, the ProShares S&P 500 Dividend Aristocrats ETF, stands out as a prominent option for investors.

It tracks the S&P 500 Dividend Aristocrats Index, composed of S&P 500 companies that have increased dividends for at least 25 consecutive years.

With its emphasis on quality and longevity, NOBL seeks to provide both income and growth, aligning with the goals of many in the 30 to 65 age range.

Individual Dividend Aristocrats Stocks

When we talk about Individual Dividend Aristocrats Stocks, we’re focusing on companies that have not only paid dividends but have consistently increased them for at least 25 consecutive years.

These companies are often seen as high-quality dividend stocks due to their stable earnings and strong histories.

Sector Breakdown

The Dividend Aristocrats hail from numerous sectors, showcasing a diversified mix that can provide stability and growth.

Sectors like Consumer Goods, Technology, and Industrials are well represented. By maintaining investments across these varied sectors, we can aim for a balanced portfolio that taps into different market dynamics.

- Consumer Goods: Essential to everyday life, this sector often remains stable even in fluctuating economies.

- Technology: A growing sector that’s reshaping our world and can contribute significant growth to our dividend investments.

- Industrials: Fundamental to the economy, industrials encompass a range of businesses that often have long-standing dividend histories.

Notable Companies

Several key players stand out in the Dividend Aristocrats category, each with a reputation for delivering consistent and growing dividends across various market conditions. We’ll discuss a few noteworthy examples:

- Exxon Mobil: A titan in the energy sector, Exxon Mobil exemplifies the robust nature of dividend aristocrats within volatile industries.

- Coca-Cola: As a staple in consumer goods, Coca-Cola demonstrates enduring appeal and financial strength with its extensive history of dividend growth.

- Target: The retail giant has proven to be a resilient dividend payer, illustrating the consumer sector’s potential for long-term investors.

- Genuine Parts: This company’s focus on vehicle and industrial parts has anchored it as a reliable choice in the industrial sector.

- Dover: Known for its industrial machinery, Dover maintains a steady record of dividend increases, painting a picture of a sturdy industrial player.

By understanding the sector breakdown and familiarizing ourselves with notable companies, our approach to investing in Dividend Aristocrats becomes both strategic and informed.

Financial Metrics and Performance Indicators

When we evaluate Dividend Aristocrats, we focus on specific financial metrics and performance indicators that signal the health and potential of these investments.

We look at the dividend yield, market capitalization, and total return to get a comprehensive view of these companies.

Dividend Yield Analysis

Dividend yields are a key metric for assessing Dividend Aristocrats. We recently advised a client whose dividend yield was lagging despite strong company fundamentals; after reevaluating her portfolio, we shifted focus toward stocks with stronger yields.

Investors should compare the dividend yield of an aristocrat to the industry average and the broader market to gauge its attractiveness. Here’s the importance of examining dividend yields:

- Dividend Yield: It indicates the income a stock pays out relative to its share price.

- Growth Stability: Aristocrats typically have stable and growing yields over time.

Total Return

The total return of a Dividend Aristocrat is the combination of capital appreciation and dividend payments. We often remind our peers that dividend reinvestment can markedly impact the total return over time. For a robust portfolio, we recommend:

- Reviewing Historical Returns: This helps identify long-term performance trends.

- Considering Dividend Reinvestment: It can significantly enhance overall returns.

Market Capitalization

Market capitalization, or market cap, offers insights into the size and stability of a company. Dividend Aristocrats tend to have large market caps, signaling solid market positions. Here’s what to look at:

- Size and Stability: Larger companies with big market caps may provide more stable returns.

- Ticker Reference: It’s important to track the ticker symbols of these stocks for quick reference and analysis.

Impact of Economic Factors

As we navigate the investment landscape, understanding the impact of economic factors on Dividend Aristocrats is crucial. Our focus will be on how economy fluctuations and liquidity, paired with trading volume, influence these resilient entities.

Effects of Economy Fluctuations

The performance of Dividend Aristocrats is inextricably linked to the broader economy.

When the economy faces a downturn, consumer spending tends to decline, which can lead to reduced corporate profits and potentially strained dividend payments.

Conversely, in a thriving economy, increased consumer confidence often translates to robust financials, cementing the ability of these companies to maintain and grow their dividends.

In my years of advising, I’ve seen Dividend Aristocrats act as economic bellwethers; their dividend consistency often signals financial stability that can withstand the ebbs and flows of economic tides.

Liquidity and Trading Volume

Liquidity and trading volume together paint a picture of the market’s overall health and enthusiasm towards Dividend Aristocrats.

High liquidity generally means that shares can be bought and sold rapidly without substantial price changes, which is a desirable trait during volatile market conditions.

Dividend Aristocrats, known for their stable dividends and solid financials, typically enjoy higher liquidity. Additionally, these companies often see substantial trading volumes around ex-dividend dates, as investors aim to capture imminent dividend payouts.

Creating a Diversified Dividend Portfolio

Dividend investing can serve as a pathway to building wealth, as it focuses on generating regular income along with potential price appreciation. We can enhance shareholder value and secure a stable financial future through careful strategy.

Building an Investment Strategy

When constructing a diversified dividend portfolio, Exchange-Traded Funds (ETFs) often serve as a cornerstone due to their inherent diversification benefits. ETFs allow us to invest in a basket of dividend-paying stocks, spreading risk across various sectors and geographic locations. This approach helps mitigate the impact of any single stock’s performance on overall portfolio health.

Selecting the right dividend-paying stocks is crucial. We look for Dividend Aristocrats, companies with a history of increasing dividends for at least 25 consecutive years. These companies are typically well-established and financially stable, suggesting a reliable stream of dividends and potential for price appreciation.

Investment in Dividend Aristocrats can be particularly strategic, as their long history of dividend payments demonstrates a commitment to returning value to shareholders. This often translates into a more predictable income stream for investors.

By balancing our holdings between individual stocks and ETFs, our portfolio can benefit from both targeted investments and broad market exposure.

This balance is essential in achieving the dual goals of income generation and capital growth.

We must also be vigilant in assessing the yield, payout ratio, and growth potential of our dividend-paying assets to ensure they align with our financial objectives.

Remember, our aim is to build a portfolio that not only provides income but also contributes to overall wealth accumulation through disciplined reinvestment and capital gains. Through consistency and a focus on shareholder value, we can look forward to a more secure financial future.

Comparative Analysis

In the realm of dividend investing, Dividend Aristocrats are often benchmarked against other indices and vary across regions, presenting a nuanced landscape for investors to navigate.

Dividend Aristocrats vs. Other Indices

Dividend Aristocrats are a select group of companies that have consistently increased their dividend payouts for at least 25 consecutive years.

In the United States, the S&P 500 Dividend Aristocrats is the most prominent index showcasing these companies. When compared with broader indices such as the S&P 500 or the Dow Jones Industrial Average, Dividend Aristocrats tend to demonstrate less volatility and more stable returns over time, owing to their proven track record of financial resilience and commitment to returning capital to shareholders.

It’s notable that, despite potential underperformance during market rallies, Dividend Aristocrats often offer downside protection in market downturns, making them a preferred choice for many long-term investors.

For example, during the financial crisis of 2008–2009, many investors found their portfolios insulated from the fullest brunt of the downturn by holding positions in Dividend Aristocrats.

Dividend Aristocrats in Different Regions

The concept of Dividend Aristocrats is not exclusive to the United States.

In regions such as Europe and Asia, similar indices exist to highlight companies with strong dividend histories. Japan and South Korea have their own versions of dividend-focused indices, though the criteria and the number of consecutive years of dividend growth required may differ.

For instance, the criteria for being a Dividend Aristocrat in Japan might not be as stringent as the 25-year requirement in the United States.

The attention to dividend-paying companies in different regions emphasizes the value placed on corporate stability and shareholder returns worldwide.

While the exact lineup of Dividend Aristocrats may differ, the underlying investment thesis remains the same: companies that can consistently raise their dividends may be better positioned to weather economic storms and provide reliable income streams.

By understanding the comparative performance and composition of Dividend Aristocrats across various indices and regions, investors can more effectively tailor their investment strategies to meet their individual financial goals and risk tolerance.

Investor Considerations

When evaluating Dividend Aristocrats, we must carefully consider our strategy to optimize long-term wealth and shareholder value. Diving into specifics, let’s break down the components that shape a successful investment in these reliable dividend-paying stocks.

Assessing Individual Stocks vs. ETFs

Choosing between investing in individual Dividend Aristocrat stocks and exchange-traded funds (ETFs) is a pivotal decision.

When we select individual stocks, it allows for a tailored approach, focusing on companies that we believe have strong prospects. However, this requires a thorough valuation of each company and a deep understanding of industry dynamics.

On the other hand, ETFs that track Dividend Aristocrats offer diversification, reducing the risk associated with any single stock.

For example, SPDR S&P Dividend ETF aggregates many high-performing dividend stocks, which might be more efficient for our portfolio.

Investor Tip: When analyzing an individual stock, look beyond the dividend yield; assess the payout ratio and earnings growth to gauge sustainability.

Understanding Valuation and Performance

The valuation of Dividend Aristocrats is crucial to ensure we do not overpay for these stocks.

We should scrutinize price-to-earnings (P/E) ratios and compare them against historical averages and sector benchmarks.

Moreover, performance is not only about past dividend growth but also about how the company may fare in varying economic landscapes.

Reviewing the historical performance during market downturns can provide insights into potential future resilience.

Personal Anecdote: In my experience, investors who focus on valuation fundamentals and dividend growth rather than chasing high yields tend to achieve more stable and consistent growth over time.

Long-Term Wealth and Shareholder Value

Dividend Aristocrats are often considered a foundation for long-term wealth creation due to their history of paying and increasing dividends. This consistent cash flow can be reinvested to compound wealth while offering a measure of inflation protection.

Shareholder value is not just in dividend payouts but also in the potential for stock price appreciation. Companies in the Dividend Aristocrats index typically have strong corporate governance and financial health, which are vital for sustainable growth and returns.

Key Takeaway: A strategy that combines reinvesting dividends and selecting fundamentally strong companies aligns with our goal of wealth accumulation and maximizing shareholder value.

Notable Dividend Aristocrats Companies

Dividend Aristocrats tend to be established, reliable firms we often refer to as blue-chip companies. They have a history of sustained dividend growth, indicating stable financial health and reliable management practices.

Blue-Chip Companies and Dividend Aristocrats

Blue-chip companies carry a reputation for financial stability, longevity, and strong market presence.

The designation of Dividend Aristocrat is reserved for members of the S&P 500 that have not only paid but also increased their base dividend for at least 25 consecutive years. This blend of consistent performance and enduring dividends makes them particularly appealing.

- Chevron (CVX) and 3M (MMM): Both are quintessential examples of blue-chips with marked track records in dividend growth.

- Walmart (WMT): Renowned for its retail dominance and has steadily grown its dividend over the decades.

- In our experience, firms like Walmart have demonstrated an ability to navigate economic cycles, often emerging stronger from downturns. (Opinion)

- The Coca-Cola Co (KO) and McDonald’s Co (MCD): These consumer giants are not only ubiquitous in day-to-day life but also in dividend portfolios, reflecting their stable earnings streams.

- AbbVie (ABBV) and Medtronic (MDT): They prove that healthcare entities can offer both growth and dividends, vital for a balanced portfolio.

Detailed Profiles of Selected Companies

While it is valuable to know that a company is a Dividend Aristocrat, understanding the specifics can help us make more informed investment decisions.

Chevron:

- Industry: Energy

- Dividend Increase Streak: 34 years

Walmart:

- Industry: Retail

- Dividend Increase Streak: 47 years

Medtronic:

- Industry: Healthcare

- Dividend Increase Streak: 43 years

AbbVie:

- Industry: Biopharmaceuticals

- Dividend Increase Streak: 48 years (including time as part of Abbott Laboratories)

- We’ve seen AbbVie’s commitment to innovation in drug development coincide with regular dividend increases, a testament to their sound financial governance.

The Coca-Cola Co:

- Industry: Beverages

- Dividend Increase Streak: 59 years

McDonald’s Co:

- Industry: Foodservice

- Dividend Increase Streak: 45 years

3M Company:

- Industry: Conglomerate

- Dividend Increase Streak: 63 years

In providing this snapshot, we aim to paint a clearer picture of the companies whose names come up frequently when discussing Dividend Aristocrats. Careful scrutiny of each can reveal which might align best with our investment goals.

Future of Dividend Aristocrats

Dividend Aristocrat stocks have long been revered for their consistent dividend payouts and the resilience they can add to a portfolio.

As financial advisors, we keep a close watch on these stocks to guide our clients towards reliable income streams.

Trends and Predictions

The landscape for Dividend Aristocrat stocks is expected to evolve with broader economic changes.

Historically, these companies have managed to raise their dividends year after year, a testament to their enduring business models and financial discipline.

However, investors should consider the sustainability of the dividend yield, particularly in industries facing technological disruption or regulatory changes.

Steady dividend payments may reflect a company’s health and its management’s confidence in future cash flows.

Yet, we anticipate that as global market conditions fluctuate, some sectors may find maintaining their aristocratic status challenging. Investors should look for Aristocrats with the ability to adapt and grow earnings in a dynamic economy.

Impact of Market Changes

The stock market and economy play crucial roles in influencing the performance of Dividend Aristocrat stocks. In a bear market or economic downturn, even well-established firms may struggle to uphold their dividend growth. Conversely, during economic expansions, these stocks can be valuable anchors, offering stability and predictable returns.

We have observed that Dividend Aristocrats can act as a buffer in volatile markets due to their historical performance of providing investors with steady dividend income.

However, should interest rates rise significantly, the relative appeal of these high-dividend-paying stocks might diminish as investors seek higher yields from other investments. It’s necessary for us to remain vigilant and responsive to these shifts to realign our strategies and recommendations accordingly.

Resources

When investing in Dividend Aristocrats, it’s crucial to have access to reliable resources that can guide our decision-making process. We must consider trading volume and investment tools while keeping abreast of wealth maximization strategies.

Finding Accurate and Up-to-date Information

Investing in Dividend Aristocrats requires timely and accurate information. To assess trading volume and the financial health of these companies, we frequently consult resources such as the Comparative Analysis of Dividend Policies, which helps us understand market behaviors.

Tools and resources we consider vital:

- Financial news outlets for daily trading volumes

- Historical dividend data from reputable financial databases

- Reports on wealth and dividends

Analytical Tools and Platforms

Robust analytical platforms empower us to make informed investment decisions. Our arsenal includes various investment tools that enable detailed analysis of Dividend Aristocrat performance metrics.

Key features of these tools include:

- Real-time tracking of stock performance and trading volumes

- Comparative wealth analysis based on historical data

Analytical platforms also offer simulations and projections, which are integral in our strategy planning. I recall utilizing these tools during market volatility to reassure clients about their investment paths based on solid, long-term wealth accumulation trends among Dividend Aristocrats.

Conclusion

In our analysis, we have observed the resilience and steady performance of Dividend Aristocrats. These companies, with their long history of stable and growing dividends, provide a potential hedge against market volatility.

By integrating such assets into our portfolios, we may balance growth potential with a defensive approach to income investment.

Dividend Aristocrats carry a badge of financial strength, often stemming from robust business models and experienced management.

Our research aligns with studies suggesting the S&P 500 Dividend Aristocrat index tends to outperform the broader market over the long term.

Furthermore, these companies not only offer dividends as an income stream but may also provide capital appreciation over time.

As we plan for retirement or seek to grow our wealth, companies within the Dividend Aristocrat spectrum warrant careful consideration.

However, it’s important to conduct due diligence, as past performance is not always indicative of future returns. Diversification across sectors and geographies remains a time-tested strategy within the realm of dividend investing.

To conclude, as your financial advisors, we advocate a measured approach to include Dividend Aristocrats in our investment dialogue.

Our collective experience underscores the importance of balance and diversification, with an eye toward long-term financial health. Let us continue to explore these opportunities together, reconciling our aspirations with prudent financial strategies.

Frequently Asked Questions

In this section, we’ll answer some of the most frequently asked questions about Dividend Aristocrats. These questions span from the specific criteria for a company’s qualification to the comparative performance of these prestigious stocks against the S&P 500 index.

What are the criteria for a company to be considered a Dividend Aristocrat?

To qualify as a Dividend Aristocrat, a company must be listed on the S&P 500 index and have a history of increasing its dividend for at least 25 consecutive years. Additionally, the company must meet certain size and liquidity requirements.

How do Dividend Kings compare to Dividend Aristocrats in terms of investment stability?

Dividend Kings, having raised their dividends for at least 50 years, can be considered even more stable compared to Dividend Aristocrats. This extended period of consistent growth suggests a robust business model and financial discipline, which could offer an even greater sense of security for investors.

Can you list the most reliable ETFs that track the performance of Dividend Aristocrats?

Several ETFs specifically focus on tracking Dividend Aristocrats. Examples include the ProShares S&P 500 Dividend Aristocrats ETF and the SPDR S&P Dividend ETF. These provide convenient exposure to an entire cohort of dividend-growing companies.

What has been the historical performance of Dividend Aristocrats compared to the broader S&P 500 index?

Historically, Dividend Aristocrats have outperformed the broader S&P 500 index. This is attributed to the strong fundamentals and consistent dividend growth of the companies, which can lead to outperformance especially in volatile or bearish market conditions.

What are the potential benefits of including Dividend Aristocrats in an investment portfolio?

Including Dividend Aristocrats can offer benefits such as potential for above-average yield, lower volatility, and the possibility of capital appreciation. These companies represent a commitment to shareholder value, which can be attractive in various economic conditions.

How many companies currently hold the status of Dividend Aristocrat, and what sectors are they typically in?

As of the latest rebalancing, there are over 60 companies classified as Dividend Aristocrats. They can be found across multiple sectors, but there is often a concentration in sectors like Consumer Goods, Industrial, and Healthcare, reflecting the broad market’s enduring sectors.

Position Disclosure: As of the original writing of this article, the author(s) own or manage positions in the following: ABBV, XOM, TGT, KO, MCD, WMT, CVX, and JNJ.