Interest vs Dividends: A Direct Comparison for Informed Investor Decisions

Defining Interest and Dividends

Ever wondered how your investments make money over time? Could you be leaving money on the table with your investments? In this article, you will learn the critical distinctions between interest and dividends to ensure you’re capitalizing on every opportunity.

In the world of investments, understanding how money generates more money is foundational. Interest and dividends are two different streams of income that can prove beneficial in the portfolios we manage for our clients. Here’s a focused explanation of each, along with the benefits they may bring to an investment strategy.

Related Posts: Explore investments that earn interest and those investments know for paying dividends to investors.

Interest Earnings

Interest represents the payment we receive for lending our capital. It is typically set as a percentage of the principal amount.

Think of it like the rent someone pays for using our money. Banks and bonds are familiar sources of interest income, and the rate can be fixed or variable.

- Fixed-rate interest: guarantees a set percentage return over a period of time.

- Variable-rate interest: fluctuates based on underlying benchmark rates.

For example, if we invest in a bond with a fixed annual interest rate of 5%, on a principal of $1000, we’d earn $50 in interest per year.

Dividend-Paying Stocks

Dividends are the slice of profits a company distributes to its shareholders. Not all companies pay dividends, as some may reinvest all their earnings back into the business.

When building a portfolio for dividends, we generally consider the company’s history of dividend payments and their ability to maintain and grow those dividends over time.

- Regular dividends: These are paid out on a schedule (e.g., quarterly or annually).

- Special dividends: Occasionally, a company may pay these on an ad-hoc basis, often signaling exceptionally strong earnings.

When we talk about high-dividend stocks, we often refer to utility companies; they are known for generating consistent dividends due to their stable cash flow.

Comparison Table: Interest vs Dividends

| Feature | Interest | Dividends |

|---|---|---|

| Source | Debt instruments (e.g., bonds) | Equity (stocks) |

| Payment Type | Fixed or variable rate | Regular payments or special distributions |

| Tax Treatment | Often taxed as ordinary income | Qualified dividends may be taxed at a lower rate |

| Stability | Depends on the reliability of the borrower | Linked to company’s profitability and policy |

As experienced investment managers, we guide our clients toward the option that aligns with their financial goals, whether it be the predictable nature of interest or the growth potential and tax advantages often associated with dividends.

Economic Considerations

In making investment decisions, it’s crucial to understand the fundamental differences between interest income and dividend income, particularly in their respective rates and potential impact on returns.

Fixed Interest Rates

Fixed interest rates offer us predictable returns, which are detailed in the instruments’ terms. For bond investments, interest is paid at these predetermined rates regardless of the issuing company’s performance.

This provides a steady income stream, making it a preferred option for investors who prioritize stability over higher, but variable, returns.

Dividend Yield Calculation

The dividend yield is a critical metric for us to assess the returns on a stock investment relative to its price. We calculate it by taking the annual dividends per share and dividing it by the current share price.

Unlike fixed interest rates, dividends can fluctuate and are not guaranteed, as they are directly linked to the company’s profitability and decisions by its board.

| Stock | Annual Dividends per Share | Current Share Price | Dividend Yield |

|---|---|---|---|

| A | $2.00 | $40 | 5% |

| B | $1.50 | $30 | 5% |

Interest Rate Impact

Interest rates impact both dividend and interest income, but in different ways. When interest rates rise, new bonds may offer higher rates, making existing bonds with fixed rates less attractive, potentially decreasing their value.

For stocks, rising interest rates can dampen companies’ growth expectations, possibly leading to lower dividends and hence affecting the dividend yield.

Understanding this dynamic helps us make informed decisions about when to enter or exit investments.

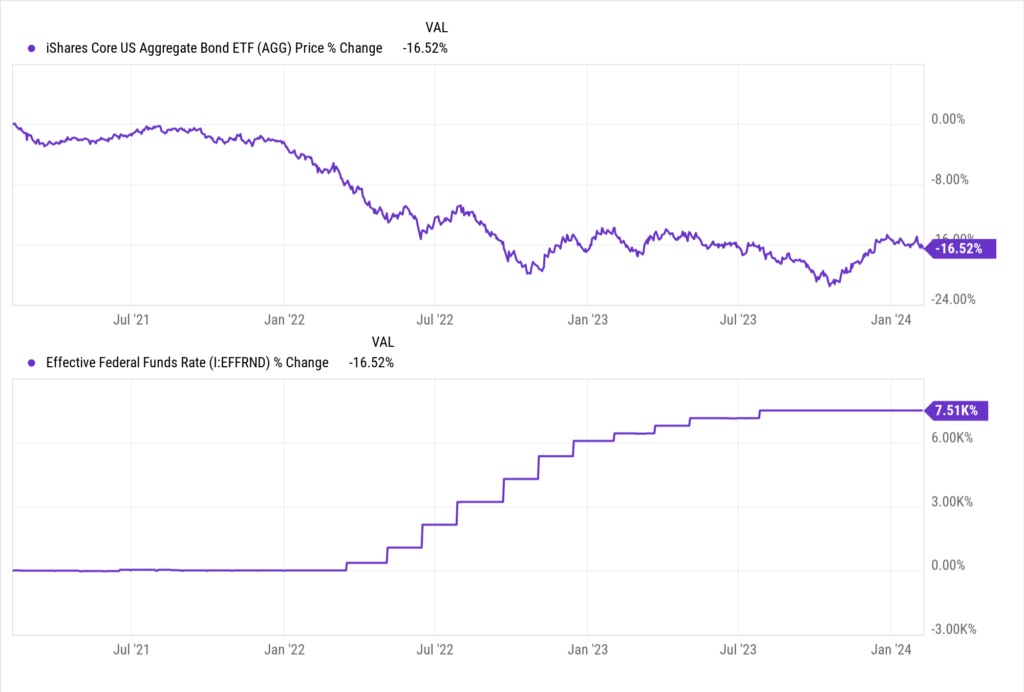

Real World Example: In 2022, the Federal Reserve began rapidly increasing the Fed Funds Rate, which directly impacts interest rates. As Rates go up, bond prices must come down. It is an inverse relationship. As a result, there was a material sell-off in bond prices. As a financial advisor, it was not fun trying to explain why what is supposed to be a more conservative investment (bonds) was down in value more than the S&P 500 index (stocks).

Here is a chart so you can see rates going up (lower section) and bond prices going down (upper section):

Investment Strategy Perspectives

When we consider how to optimize returns, it’s essential to understand the different income streams investments can provide.

Interest and dividends, for example, play pivotal roles depending on whether we prioritize consistent income or growth potential.

Interest and Dividend

Interest from investments, such as bonds or savings accounts, represents a fixed income that is received over time.

Typically, these interest payments provide a steady stream of income, which can be ideal for our conservative investments. On the other hand, dividends are payments made by a company to its shareholders out of its profits.

While they can be less predictable than interest, dividends indicate a company’s financial health and commitment to returning value to shareholders.

Understanding the differences between dividends and interest payments is crucial here, as it impacts our decision-making process.

| Type | Characteristics | Duration | Risk |

|---|---|---|---|

| Interest | Fixed income, consistent | Set periods | Lower |

| Dividends | Variable, dependent on profits | Quarterly | Higher, varies |

Interest provides us with a lower risk profile, which serves our need for stability. However, with dividends, we’re often pursuing a blend of income and growth, understanding that there could be variability in the income stream.

Equity Income

Equity income focuses on investments in stocks that pay regular dividends. Our intent here is to seek out companies with strong histories of dividend payments, indicating stability and a shareholder-friendly policy.

Over time, we may benefit from both the income from these dividends and potential capital appreciation of the stock.

Investing for equity income is often synonymous with having a patient, long-term investment approach. For instance, when I started investing in dividend-paying stocks, I prioritized firms with a track record of increasing payouts, which significantly bolstered my portfolio’s value over the years.

Investing with a focus on dividend interest should align with our broader financial goals.

While the allure of high dividends is strong, we must keep in mind that a balanced approach may often yield the best long-term results, favoring neither extreme growth nor yield but rather the sweet spot in between.

Financial Calculations and Formulas

Recommended Reading: Explore over a dozen Investing Rules of Thumb

In the realm of investing, precise financial calculations are our cornerstone. We focus on how the time value of money influences our investment decisions, particularly through the lens of interest and dividends.

Compound Interest Formula

Compound interest is the concept of earning interest on interest, which can significantly boost our investment growth over time. The formula for compound interest is:

A = P (1 + r/n)^(nt)

Where:

- A is the future value of the investment/loan, including interest

- P is the principal investment amount (the initial deposit or loan amount)

- r is the annual interest rate (decimal)

- n is the number of times that interest is compounded per year

- t is the number of years the money is invested or borrowed for

To illustrate with an example, if we invest $10,000 at an annual interest rate of 5%, compounded monthly (n=12) for 5 years, our calculations would look like this:

- P = $10,000

- r = 5/100 = 0.05

- n = 12

- t = 5

Plugging those numbers into our formula would give us:

A = $10,000 (1 + 0.05/12)^(12*5)

This formula allows us to calculate not just our returns but also the impact of interest on dividends when we reinvest them.

Dividends, when reinvested, can also benefit from compounding, similar to how interest works. Our dividends can earn more dividends, accelerating the growth of our investment.

For a practical investing strategy that takes into account this compounding effect, we can employ the Rule of 72 to estimate how long it will take for our investments to double at a given interest rate.

In my early days as an investment manager, I saw firsthand the power of compounding. A client reinvested their dividends into buying more shares of the dividend-paying stocks, setting off a compounding effect that significantly increased the value of their portfolio over the years.

Our key takeaway is that whether dealing with interest or dividends, understanding and utilizing the compound interest formula is essential. It can help us forecast our investment’s growth and make more informed decisions about where and how to invest our funds for maximum return.

Taxation and Legal Considerations

As an investment manager, it’s crucial for us to understand the fiscal implications of different income streams. Interest and dividends not only behave differently in an investor’s portfolio but are also subject to distinct tax treatments.

Dividend Taxation

Dividends are payments made by a corporation to its shareholders from its after-tax profits. Unlike interest, which is often taxed as ordinary income, dividends can qualify for lower tax rates.

However, we have to be alert to the fact that not all dividends qualify; only “qualified dividends” are taxed at the capital gains rates, which can be significantly lower.

It’s important for us to remind new investors that tax laws are subject to change, and strategies that are advantageous today may be less so in the future. This is particularly relevant when we consider Tax Considerations for New Investors, which is an essential knowledge piece that can maximize investment efficiency.

Dividends can be reinvested, which exerts compound growth on our clients’ portfolios. We historically observed that when dividends were reinvested, the snowball effect of compounding led to impressive growth over time.

But the tax implications must not be overlooked, as they consume a portion of the returns – it’s a delicate balance to manage.

To illustrate this, consider the following table showing the tax differences:

| Income Type | Ordinary Tax Rate | Qualified Dividends Tax Rate |

|---|---|---|

| Interest | Up to 37% | N/A |

| Dividends | Up to 37% | 0%, 15%, or 20% |

This table clearly delineates the potential tax benefits of qualified dividends over interest for our investors.

Keeping abreast of the latest tax laws ensures that we remain strategic in our investment allocations and aware of the potential impact on returns.

Comparison Analysis

In this section, we’ll dissect the characteristics of interest and dividend income, helping investors understand the fundamental differences. We’ll discuss the implications of each on your investment strategy and portfolio.

Dividend or Interest

Dividends are payments made by a company to its shareholders from the profits earned; they are typically considered a sign of a company’s health and future prospects.

We find that mature companies with stable earnings are more likely to pay regular dividends, which can provide investors a steady income stream.

On the other hand, interest is paid on bonds or other fixed-income investments, representing a fixed obligation the issuer must pay to bondholders, an income that is generally predictable and less dependent on the issuer’s profitability.

Dividend Payments

- Stability: Invest in dividend aristocrat stocks known for their long history of consistent dividend payments.

- Growth Potential: Dividends may increase over time if the company’s earnings grow.

Interest Payments

- Predictability: Interest provides a fixed income, irrespective of the company’s performance.

- Risk Profile: Generally considered lower risk compared to dividends which are not guaranteed.

| Dividend Income | Interest Income |

|---|---|

| Potentially grow over time | Fixed amount |

| Not guaranteed, depends on profits | Guaranteed as per contract |

| May qualify for preferential tax rates | Taxed as ordinary income |

When comparing dividends to interest income, one must consider their own investment goals.

If you’re looking for potential growth and can handle variability, dividends might be more attractive. However, if steady income is what we’re after, interest could be the cornerstone of our strategy.

From our experience, investment decisions depend on individual preferences and financial objectives.

For example, blue chip dividends might appeal to risk-averse investors looking for both stability and modest growth, whereas bonds might be suitable for those prioritizing capital preservation.

Both strategies can be foundational elements within a diversified investment portfolio, each with its unique risk and return characteristics.

Frequently Asked Questions

Understanding the nuances between interest and dividends can significantly impact our investment strategy and tax liabilities.

What are the tax implications for investors receiving interest as opposed to dividends?

Interest income is taxed as ordinary income at our marginal tax rate, which may lead to a higher tax liability depending on our income bracket. In contrast, qualified dividends are taxed at a lower capital gains rate, which can be advantageous for us in preserving more of our investment returns.

How does the treatment of interest and dividends differ in a savings account scenario?

In a savings account, the interest we earn is considered income and taxed annually. Dividends, however, are not applicable in a traditional savings account context as they are typically associated with investments such as stocks or mutual funds.

In terms of income types, how are interest and dividends categorized for investors?

Interest is categorized as earned income, while dividends are considered investment income. This distinction is crucial for us for tax purposes and investment planning, as different income types can influence our overall financial strategy.

What sources provide information on interest and dividend income for investment tracking?

Brokerage statements and tax documents such as 1099-INT for interest and 1099-DIV for dividends are key documents. These sources are essential for us to accurately track and report our investment income.

How can investors calculate the potential returns from interest versus dividend investments?

We can calculate interest income using the formula Interest = Principal x Rate x Time. Dividends are calculated based on the dividend yield; Annual Dividends = Shares x Dividend per Share. We should consider using financial calculators or investment software to help us with these calculations.

Why might an investor have a preference for dividend-paying investments over those offering interest?

Our preference for dividend-paying investments might stem from their potential tax advantages and the opportunity for capital appreciation. Dividend-paying stocks also indicate a company’s financial health, which can reassure us of the investment’s stability and long-term growth potential.