Navigating Volatility with High Yield Stocks!

In today’s unpredictable market, high yield stocks offer a promising path to stability and growth. Discover how savvy investors are navigating volatility and capitalizing on these robust opportunities.

Understanding High Yield Dividend Stocks

As a financial advisor, we understand the importance of investing in the right stocks to meet your financial goals. High yield dividend stocks are one such investment option that can provide investors a steady income stream.

This section will discuss the basics of high yield dividend stocks, including their definition and benefits.

Defining High Yield Dividend Stocks

A high yield dividend stock is a stock that pays a dividend yield higher than the average dividend yield of the market. Dividends are a portion of a company’s profits that are paid out to shareholders.

The dividend yield is the annual dividend payment divided by the stock price.

For example, if a stock pays an annual dividend of $2 per share and its stock price is $50, its dividend yield is 4%.

High yield dividend stocks typically have a 4% or higher dividend yield. These stocks are often found in mature industries such as utilities, real estate, and telecommunications.

However, it’s important to note that a high dividend yield doesn’t always mean a good investment. A company with a high dividend yield may be struggling financially and may not be able to sustain its dividend payments in the long run.

Benefits of High Dividend Yield Investments

Investing in high dividend yield stocks can provide several benefits to investors. Firstly, they can provide a steady stream of income to investors. This can be especially beneficial for retirees who rely on their investments for income.

Secondly, high dividend yield stocks can provide a cushion against market volatility. While stock prices may fluctuate, the dividend payments from high yield dividend stocks can provide a stable source of income.

Thirdly, high dividend yield stocks can provide a potential for capital appreciation. Companies that pay high dividends are often mature and stable, which can lead to long-term growth and stability.

In conclusion, high yield dividend stocks can be a great investment option for investors looking for a steady stream of income and stability in their portfolio.

However, it’s important to do your research and ensure that the company is financially stable and can sustain its dividend payments in the long run.

As always, we recommend consulting with a financial advisor before making any investment decisions.

Assessing Market Volatility

As a financial advisor, we understand that market volatility can be a source of anxiety for investors.

However, it is important to remember that volatility is a natural part of the stock market. It is crucial to assess market volatility to make informed decisions about investing in high yield stocks.

Impact of Volatility on High Yield Stocks

High yield stocks, also known as dividend stocks, are stocks that pay a higher dividend yield than the average yield of the stock market.

These stocks are often sought after by investors looking for a steady income stream. However, high yield stocks can be impacted by market volatility.

During times of market volatility, high yield stocks may experience a decline in price. This is because investors may sell off these stocks in favor of less risky investments.

Additionally, companies may cut or suspend their dividends during times of economic uncertainty, which can negatively impact the value of high yield stocks.

Strategies to Navigate Stock Market Volatility

Despite the potential impact of market volatility on high yield stocks, there are strategies that investors can use to navigate through these uncertain times.

One strategy is to diversify your portfolio. By investing in a variety of high yield stocks across different industries, you can mitigate the risk of any one stock or sector experiencing a decline in price.

Additionally, diversification can help protect your portfolio from the impact of persistently high inflation.

Another strategy is to focus on the long-term. While it can be tempting to sell off high yield stocks during times of market volatility, it is important to remember that these stocks are often chosen for their steady income stream.

By holding onto these stocks over the long-term, you can continue to receive a reliable source of income.

Lastly, working with a financial advisor to assess your risk tolerance and investment goals is important. A financial advisor can help you develop a personalized investment strategy that takes into account your individual needs and circumstances.

In conclusion, assessing market volatility is crucial for investors looking to invest in high yield stocks.

Investors can make informed decisions about their investments by understanding the impact of volatility on these stocks and implementing strategies to navigate through uncertain times.

Portfolio Diversification with Dividend Stocks

As a financial advisor, we understand that portfolio diversification is key to reducing risk and enhancing returns.

This is where dividend stocks come in. Incorporating dividend stocks into your portfolio can provide a steady stream of income while also reducing overall portfolio risk.

In this section, we will discuss how to incorporate dividend stocks into your portfolio and how to balance risk and reward.

Incorporating Dividend Stocks into Your Portfolio

When it comes to incorporating dividend stocks into your portfolio, there are a few things to keep in mind. First, it’s important to do your research and choose dividend stocks that are right for your portfolio.

One way to do this is to look for dividend aristocrats, which are companies that have increased their dividend payouts for at least 25 consecutive years. These companies tend to be stable and reliable, making them a good choice for long-term investors.

Another option is to invest in dividend-focused exchange-traded funds (ETFs) that track the S&P 500 index or stocks in the Dow Jones.

These ETFs provide exposure to a diversified portfolio of dividend-paying stocks, making them a good option for investors who want to diversify their portfolio without having to pick individual stocks.

Balancing Risk and Reward

While dividend stocks can provide a steady stream of income, it’s important to balance risk and reward when incorporating them into your portfolio.

One way to do this is to look for companies with a strong balance sheet and a history of stable dividend payments. These companies tend to be more stable and less volatile, which can help reduce overall portfolio risk.

It’s also important to keep in mind that dividend stocks are not immune to market volatility. While they tend to be less volatile than non-dividend-paying stocks, they can still experience significant price fluctuations.

For this reason, it’s important to diversify your portfolio across different asset classes and sectors to reduce overall portfolio risk.

In conclusion, incorporating dividend stocks into your portfolio can provide a steady income stream while reducing overall portfolio risk. By doing your research and choosing the right dividend stocks or ETFs, you can create a diversified portfolio that balances risk and reward.

Remember to keep in mind the importance of diversification and to choose dividend stocks or ETFs that are right for your investment goals and risk tolerance.

Analyzing Dividend Aristocrats and Kings

As we navigate through volatile markets, it’s important to consider high yield stocks such as Dividend Aristocrats and Kings. These stocks have a track record of consistently increasing dividends, which can provide a steady stream of income during turbulent times.

Criteria for Dividend Aristocrats and Kings

To be classified as a Dividend Aristocrat, a company must be a member of the S&P 500 index and have consecutively raised its dividend for at least 25 years.

On the other hand, a Dividend King must have consecutively raised its dividend for at least 50 years. These strict criteria ensure that only the most financially stable and profitable companies are included in these groups.

Performance of Dividend Aristocrats and Kings in Volatile Markets

Historically, Dividend Aristocrats and Kings have performed well during market downturns.

In fact, during the 2008 financial crisis, the S&P 500 Dividend Aristocrats Index outperformed the S&P 500 by a significant margin.

This is because these companies tend to have strong balance sheets, generate consistent cash flow, and focus long-term on growth and stability.

It’s important to note that while Dividend Aristocrats and Kings may not offer the highest yields, their focus on dividend growth can result in significant returns over time. Additionally, these stocks tend to have lower volatility compared to other high yield options such as REITs or MLPs.

As a financial advisor, we recommend considering Dividend Aristocrats and Kings as part of a well-diversified portfolio. These stocks can provide a stable source of income during market downturns and have a proven track record of long-term growth.

However, it’s important to carefully analyze each company’s financials and dividend growth history before making any investment decisions.

In summary, Dividend Aristocrats and Kings can be a valuable addition to a portfolio during volatile markets.

Their strict criteria for inclusion ensure that only the most financially stable and profitable companies are included, and their focus on dividend growth can provide significant returns over time.

As always, it’s important to carefully analyze each investment opportunity before making any decisions.

Real Estate and Energy Sector High Yield Stocks

As a financial advisor, we know that high yield stocks can be a valuable addition to a portfolio, especially during times of market volatility.

This section will explore the potential benefits of investing in high yield stocks in the real estate and energy sectors.

Real Estate Investment Trusts (REITs) with High Yields

Real Estate Investment Trusts (REITs) are companies that own and operate income-producing real estate properties.

They are required by law to distribute at least 90% of their taxable income to shareholders in the form of dividends. This makes them a popular choice for income-seeking investors.

One example of a high yield REIT is Realty Income (NYSE: O), which has a current dividend yield of around 4%.

The company owns over 6,500 properties across the United States and generates consistent rental income. It has a long history of increasing dividends, having done so for 52 consecutive years.

Energy Companies and Dividend Potential

The energy sector is another area where investors can find high yield stocks. While the sector has been volatile in recent years, there are opportunities for investors willing to take on some risk.

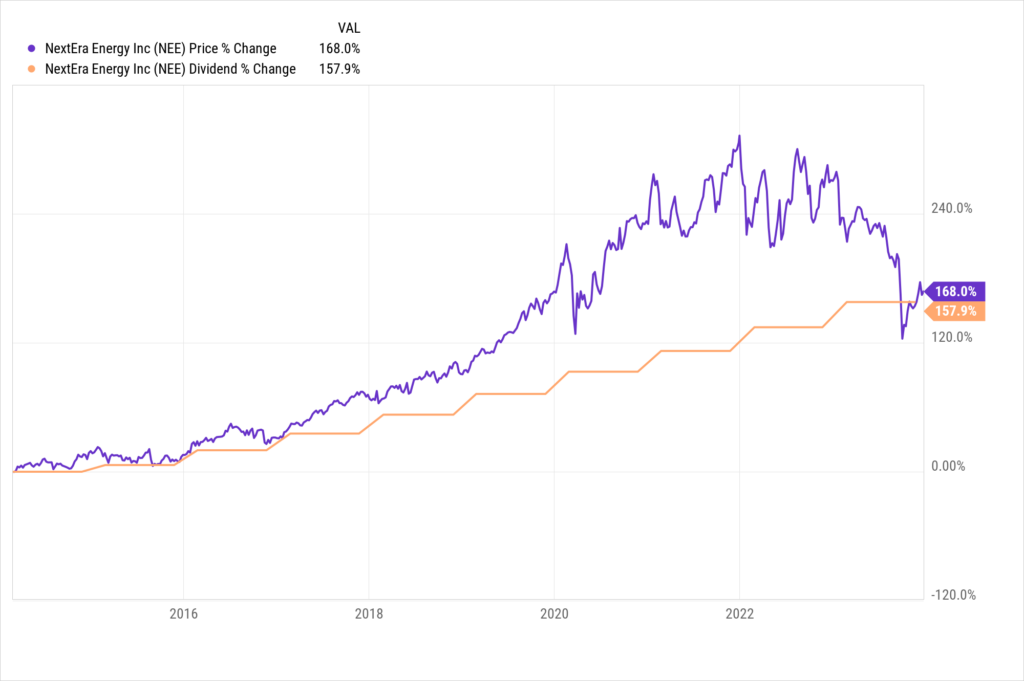

NextEra Energy (NYSE: NEE) is an example of an energy company with dividend potential. The company is a leader in renewable energy, with a focus on wind and solar power.

It has a current dividend yield of around 2%, which may not seem high, but the company has a strong track record of increasing dividends. In fact, it has raised its dividend for 16 consecutive years.

Natural gas is another area of the energy sector where investors can find high yield stocks. One example is Williams Companies (NYSE: WMB), which operates natural gas pipelines across the United States. The company has a current dividend yield of around 6%, making it an attractive option for income-seeking investors.

When considering high yield stocks in the energy sector, it’s important to keep in mind the potential risks. The sector can be volatile, and companies may face challenges related to regulatory changes or shifts in market share.

In conclusion, high yield stocks in the real estate and energy sectors can be a valuable addition to a portfolio, especially during times of market volatility. As always, it’s important to do your research and consult with a financial advisor before making any investment decisions.

Dividend Reliability and Growth Prospects

As we navigate the volatile market, it’s important to consider high yield stocks with reliable dividends and growth prospects.

In this section, we’ll discuss how to evaluate the dividend track record and future growth opportunities of high yield stocks.

Evaluating Dividend Track Records

When considering high yield stocks, evaluating their dividend track record is crucial. A company’s dividend track record refers to its history of paying dividends and increasing those payments over time.

A company that has consistently paid dividends and increased those payments over several years is a good indicator of financial stability and reliability.

To evaluate a company’s dividend track record, we recommend looking at its dividend payment history over the past five to ten years. This will give you a good idea of how reliable the company’s dividend payments have been.

Additionally, consider the company’s earnings growth over the same period. A company with consistent earnings growth is more likely to support continued dividend growth.

Future Dividend Growth Opportunities

In addition to evaluating a company’s dividend track record, it’s important to consider its future dividend growth opportunities. A company that is growing its earnings is more likely to increase its dividend payments in the future.

When evaluating a company’s future dividend growth opportunities, we recommend looking at its dividend policy. A company with a growing dividend policy is more likely to increase its dividend payments in the future.

Additionally, consider the company’s earnings growth potential. A company with a growing earnings potential is more likely to support continued dividend growth.

As a financial advisor, I always recommend diversifying your portfolio with high yield stocks that have reliable dividends and growth prospects.

By evaluating a company’s dividend track record and future growth opportunities, you can make informed investment decisions that will help you navigate the volatile market.

Personal Anecdote: One of my clients was hesitant to invest in high yield stocks because they were worried about the reliability of the dividends.

After evaluating the dividend track records and future growth opportunities of several high yield stocks, we were able to find a diversified portfolio that met their investment goals and provided reliable dividends.

Income Strategies for This Year and Beyond

As we navigate through the current economic environment, it’s important to have a solid income strategy in place.

Whether you’re a retiree looking for a reliable monthly income stream or a younger investor looking to build passive income, there are many high yield stocks that can help you achieve your financial goals.

Planning for Long-Term Income Streams

One key strategy for income investors is to focus on stocks that offer reliable and consistent cash flow.

This can be achieved by investing in companies with a history of paying monthly dividends, such as real estate investment trusts (REITs) or utility stocks. These types of stocks provide a steady income stream, making them ideal for investors who are looking for long-term income.

When selecting high yield stocks, it’s important to consider the company’s financial health.

Look for companies with a strong balance sheet and a history of paying dividends, as this indicates that the company is financially stable and has a commitment to returning value to shareholders.

Additionally, it’s important to diversify your portfolio across different sectors and asset classes to minimize risk.

Anticipating Economic Shifts and Dividend Trends

Another important strategy for income investors is to anticipate economic shifts and dividend trends.

For example, during periods of economic uncertainty, investors may shift their focus to defensive stocks, such as consumer staples or healthcare stocks, which tend to be less affected by economic downturns.

In addition, it’s important to keep an eye on dividend trends. Some companies may increase their dividend payouts over time, while others may decrease or suspend their dividends. By monitoring these trends, investors can make informed decisions about which stocks to buy or sell.

Overall, there are many high yield stocks that can provide a reliable source of passive income for investors.

By focusing on companies with a strong financial track record and anticipating economic shifts and dividend trends, investors can build a diversified portfolio of income-generating stocks that can provide long-term financial stability.

Selecting the Best Dividend Stocks for Stability

As a financial advisor, we understand that stability is key when it comes to selecting the best dividend stocks for our clients.

In times of market volatility, high yield stocks can provide a reliable source of income. However, not all dividend stocks are created equal, and choosing stocks with a proven track record of paying consistent dividends is important.

Criteria for Choosing Stable Dividend Payers

When selecting dividend stocks for our clients, we look for companies that have a strong financial position, a history of paying dividends, and a commitment to maintaining or increasing their dividend payout. Here are some of the key criteria we consider:

- Financial Health: We look for companies with a strong balance sheet and a healthy cash flow. This ensures that the company has the financial resources to continue paying dividends, even during tough economic times.

- Dividend History: We prefer companies that have a long history of paying dividends, as this demonstrates a commitment to returning value to shareholders. Companies that have consistently paid and increased their dividends over time are among the best dividend stocks for stability.

- Dividend Payout Ratio: We analyze the dividend payout ratio, which is the percentage of earnings paid out as dividends. A high payout ratio can be a red flag, as it may indicate that the company is paying out more than it can afford. We prefer companies with a moderate payout ratio, as this indicates a sustainable dividend.

Top Picks for Consistent Dividends

After analyzing these criteria, we have identified some of the best dividend stocks for stability.

These companies have an impressive dividend history, strong financials, and a commitment to maintaining or increasing their dividend payout.

- Johnson & Johnson (JNJ): This healthcare giant is among the best dividend stocks for stability, with a long history of paying and increasing its dividend. JNJ has a strong financial position, with a low payout ratio and a healthy cash flow.

- Procter & Gamble (PG): PG is a consumer goods company that has paid a dividend for over 100 years. It has a strong brand portfolio and a solid financial position, making it a reliable dividend payer.

- AT&T (T): T is a telecommunications company that has paid a dividend for over 30 years. It has a high dividend yield and a moderate payout ratio, making it an attractive option for income-seeking investors.

In conclusion, selecting the best dividend stocks for stability requires a thorough analysis of the company’s financials, dividend history, and commitment to maintaining or increasing its dividend payout.

By focusing on these criteria, we can identify high-yield stocks that provide our clients a reliable income source.

Related Reading: High Yield Dividend Stocks

Frequently Asked Questions

What are effective strategies for managing risk in high-yield, volatile stock investments?

When investing in high-yield, volatile stocks, it is important to have a risk management strategy in place. One effective strategy is diversifying your portfolio by investing in various stocks across various industries.

This can help mitigate risk and minimize the impact of any stock’s performance on your overall portfolio. It is also important to set clear investment goals and to stick to them, even during periods of market volatility.

Additionally, it can be helpful to work with a financial advisor who can guide risk management strategies tailored to your individual investment goals and risk tolerance.

How can investors maximize returns in a volatile market environment?

In a volatile market environment, it can be tempting to try to time the market and make quick trades in an attempt to maximize returns.

However, this approach can be risky and can result in significant losses. Instead, we recommend taking a long-term approach to investing and focusing on high-quality, dividend-paying stocks with a strong performance track record.

By investing in these stocks and holding them for the long term, investors can benefit from both capital appreciation and regular dividend payments.

What criteria should be used to select stocks with high volatility but promising yields?

When selecting stocks with high volatility but promising yields, it is important to consider a variety of factors, including the company’s financial health, growth potential, and dividend history.

We recommend looking for companies with strong balance sheets, stable earnings, and a history of consistent dividend payments.

It can also be helpful to look for companies that operate in industries that are poised for growth, such as technology, healthcare, and renewable energy.

What are the best practices for portfolio diversification amidst market volatility?

Portfolio diversification is key to managing risk in a volatile market environment. We recommend investing in a mix of different asset classes, including stocks, bonds, and cash.

Within each asset class, it is important to diversify further by investing in a mix of different stocks or bonds across various industries and geographic regions. This can help minimize the impact of any stock or bond’s performance on your overall portfolio.

How should an investor adjust their investment approach during periods of high market fluctuation?

During periods of high market fluctuation, it can be tempting to make quick trades or to sell off stocks in an attempt to minimize losses. However, this approach can be risky and can result in significant losses.

Instead, we recommend taking a long-term approach to investing and focusing on high-quality, dividend-paying stocks with a strong performance track record.

By investing in these stocks and holding them for the long term, investors can benefit from both capital appreciation and regular dividend payments.

What tools or indicators are most useful for predicting stock performance in a volatile market?

There are a variety of tools and indicators that can be useful for predicting stock performance in a volatile market.

Some of the most commonly used tools include technical analysis, fundamental analysis, and market sentiment indicators. Technical analysis involves analyzing charts and other technical indicators to identify trends and patterns in stock prices.

Fundamental analysis involves analyzing a company’s financial health, growth potential, and other key factors to determine its overall value.

Market sentiment indicators, such as the VIX or other volatility indices, can provide insight into overall market sentiment and investor sentiment towards particular stocks or industries.

Ultimately, it is important to use a variety of tools and indicators in order to make informed investment decisions.

Position Disclosure: As of the time of publication, the author does not have a position in NEE or WMB, the two stocks mentioned in this article.