High Yield Stock Strategies: Maximizing Dividends

Maximize your investment returns with our expert insights on high-yield stock strategies. Discover key techniques to identify and capitalize on these lucrative opportunities.

TL;DR for High Yield Stock Strategies

High Yield Stock Strategies involve investing in stocks that pay higher than average dividends, providing a steady income stream. These strategies focus on researching and selecting companies with strong financial health and a consistent history of dividend payments. Investors aim to balance the potential risks with the benefits of regular, high dividend yields, often as part of a diversified portfolio to mitigate market volatility and enhance long-term financial gains.

Understanding High-Yield Stocks

When we consider investment strategies, particularly in the realm of dividend-paying stocks, understanding high-yield stocks becomes crucial.

A high-dividend stock signifies a company that pays a larger percentage of its earnings to shareholders in the form of dividends. These are often well-established companies with stable earnings profiles.

The term “high yield” refers to the dividend yield, which is a financial ratio indicating how much a company pays out in dividends each year relative to its stock price.

High-yield stocks typically have a higher dividend yield than the average for the NYSE or NASDAQ. This can be particularly attractive to investors looking for regular income from their investments.

| Qualities of High-Yield Stocks |

|---|

| Steady revenue streams |

| Larger market capitalization |

| History of dividend payouts |

For instance, in my years as an advisor, I’ve seen retirees gravitate towards high-yield stocks for their potential to generate predictable income, akin to the steady paycheck they were accustomed to when working.

However, it is important to exercise due diligence as high yields can sometimes be misleading. A very high yield may indicate potential risk, suggesting that the dividend could be unsustainable or the stock price has fallen significantly.

Therefore, we always analyze the company’s financial health, looking at earnings, payout ratios, and future earnings projections.

Investors should also be aware that companies listed on major indices like the S&P 500 often include a mix of dividend profiles, including both high-dividend stocks and those with lower or no dividends.

It’s our job to identify which high-yield stocks are also high quality, balancing the desire for income with the need for long-term capital security.

Remember, high yield doesn’t always mean high growth, and focusing solely on the yield might not align with everyone’s investment strategy.

Our goal is to ensure any investment in high-yield stocks fits within the wider context of a diversified portfolio.

Evaluating Dividend Stocks

When selecting dividend stocks, it’s crucial to go beyond yield, focusing on sustainability and growth perspectives. Our approach integrates a comprehensive analysis to ensure we pick stocks capable of providing steady and growing income over time.

Dividend Growth Rate

The dividend growth rate is a vital sign of a company’s health and its ability to increase dividends consistently. This rate indicates how quickly a company’s dividend has grown over a specific period of time.

We always look for a steady increase, as it suggests that the company is generating more earnings and is sharing its success with shareholders.

It is worth noting that companies with a strong track record of dividend growth tend to perform well in various market conditions.

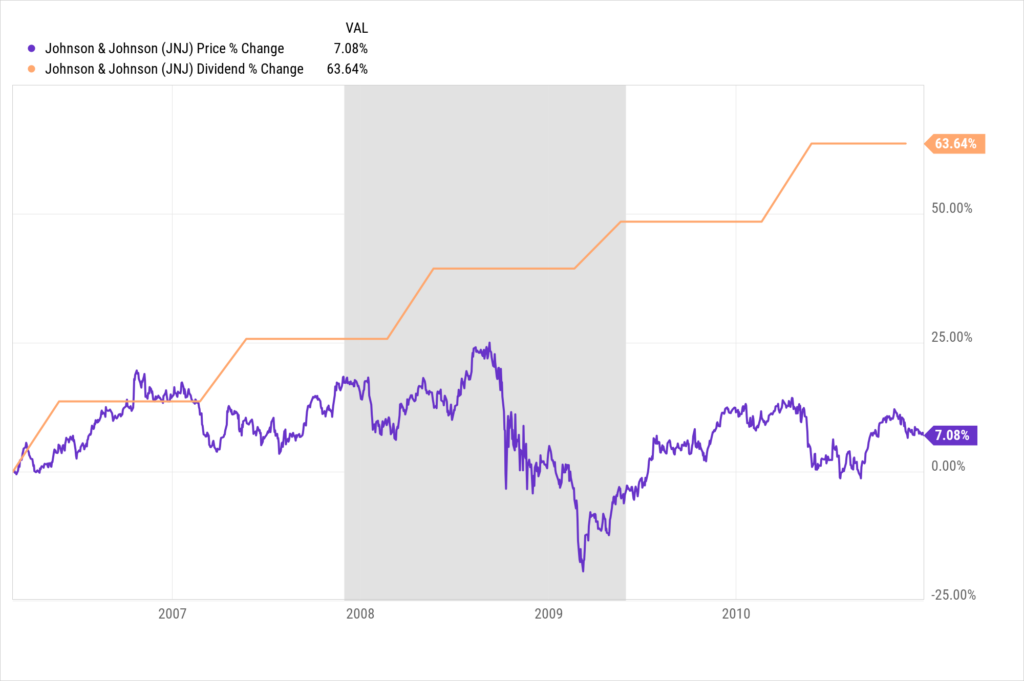

Example: JNJ Stock was able to increase their dividend even during the Great Recession of 2007-2009.

See chart:

gray = recession

purple = stock price

orange = dividend payments

Payout Ratio Analysis

A key indicator we analyze is the dividend payout ratio, which measures the proportion of earnings paid out as dividends to shareholders.

A reasonable payout ratio, typically between 35% to 55%, indicates that a company retains enough earnings to fund future growth while also rewarding shareholders.

Should this ratio be too high, it might be unsustainable; on the flip side, an excessively low ratio could imply that the company is not prioritizing shareholder returns.

Valuation Metrics

We also consider various valuation metrics to determine whether a stock is priced attractively relative to its dividend. This includes examining price-to-earnings (P/E) ratios, enterprise value-to-EBITDA, and other valuation multiples.

Stocks with low relative valuations may indicate an opportunity, especially if other indicators like dividend yield and growth are also favorable.

Yield vs. Total Return

Finally, we balance the dividend yield with potential for total return, including capital appreciation.

While a high yield can be enticing, it should never be the sole focus. We’ve learned trust in combining yield with a look at overall performance, which can sometimes point towards stocks with lower yields but greater long-term growth potential, leading to a potentially higher total return.

Stocks that manage both a healthy yield and capital appreciation are often preferred for their balanced approach to income and growth.

In our experience, this multifaceted analysis best positions investors for long-term dividend income and capital appreciation.

Strategies for High Dividend Yields

In our pursuit of robust portfolios, we prioritize stocks with high dividend yields that are indicative of steady cash flow and potential for growth.

By focusing on a meticulous stock selection process, diversification tactics, and tax considerations, we can optimize our income from dividends.

Stock Selection Process

When selecting dividend stocks, we look for companies with a strong history of cash flow that can support high yields. We consider factors like payout ratios, company fundamentals, and industry stability.

Our process often includes screening through indexes such as the S&P 500 for stocks that have consistently paid dividends. Criteria also involve looking at the financial health of a company to ensure that dividends are sustainable.

Personal Lesson: I once lost a client because she said she could buy “blue chip stocks” with dividend yields of 8.5% or more without my help. While I knew investing significant amounts on a high-yielding stock without detailed vetting can be a risky position. I tried my best to educate her on the risk, but she pulled her money from our firm and bought her own stocks. Through a mutual friend a few years later, I heard it did not turn out very well. This is a crucial lesson that not all high yields are sustainable and many times you are paying an advisor to keep you out of trouble.

Diversification Tactics

To mitigate risks, we spread investments across various sectors and asset classes. A blend of ETFs and individual dividend stocks can provide both the simplicity of exchange-traded funds and the targeted benefits of specific high yield stocks.

It is not just about increasing numbers but investing in various industries to buffer against sector-specific downturns. We may use ETFs that track dividend-focused indexes as a convenient way to achieve this diversification.

Tax Considerations

Taxation of dividends can have a significant impact on net returns. Our strategies involve understanding the tax implications of holding dividend stocks in different account types.

For instance, qualified dividends are taxed at a lower capital gains rate compared to ordinary income. Holding high yield stocks in tax-advantaged accounts such as IRAs or 401(k)s can defer or even eliminate certain taxes on dividends, enhancing the compounding effect of reinvestment.

By adhering to these strategies, we capitalize on high yields while managing risks and maximizing after-tax returns, key components for the financial resilience and growth of our portfolios.

Learn more about the taxation of high yield dividend stocks. This article goes deep into the tax topic.

Types of High-Yield Investments

When we consider high-yield investments, we’re looking at assets known for providing higher-than-average dividends or interest payments. These investments can be key to a diversified portfolio for those seeking regular income.

Real Estate Investment Trusts (REITs)

Real Estate Investment Trusts (REITs) specialize in generating income through a variety of real estate properties. By law, REITs distribute at least 90% of their taxable income to shareholders.

This makes them a solid choice when targeting consistent income streams. In our experience, clients who allocate part of their portfolio to REITs appreciate the blend of real estate growth potential with regular dividend payouts.

Business Development Companies

Business Development Companies (BDCs), much like REITs, must pay out the majority of their income in the form of dividends. They typically provide capital to small and mid-sized businesses and generate revenue through interest payments on their loans or equity stakes. BDCs can be volatile but offer high yields and potential for capital appreciation.

Energy Sector Investments

Investments in the energy sector often come with attractive yields. Energy companies can offer substantial dividend payments, partly due to their ability to generate significant free cash flow.

It’s important to note that while they can provide high returns, energy investments can also be affected by fluctuating oil and gas prices.

Consumer Staples Stocks

Stocks in the consumer staples sector are considered defensive because they produce goods that remain in constant demand—regardless of economic conditions.

These companies often boast a long history of stable dividends and might include individual stocks of large multinational corporations with solid free cash flows. We’ve seen that during market volatility, consumer staples can provide a haven while still offering attractive yields.

Understanding Risks

When considering high-yield stock strategies, it’s crucial to recognize that seeking higher returns typically involves accepting increased levels of risk.

Our guidance is shaped by substantial market experience, considering factors like market volatility, the balance between risk and reward, and specific risks tied to individual companies.

Assessing Market Volatility

Volatility refers to the frequency and magnitude of a stock’s price movements. Stocks with high volatility are considered riskier because their prices can change dramatically in a short period, impacting the total returns.

By analyzing historical price fluctuations, we can estimate potential future volatility. For instance, during periods of market unrest, such as economic downturns or political turmoil, even stalwart companies can exhibit heightened volatility.

Market Volatility Tip: High volatility can provide opportunities for buying undervalued stocks that may yield significant returns once the market stabilizes.

Risk vs. Return Trade-off

The risk vs. return trade-off is fundamental in investing; generally, the higher the risk, the higher the potential for returns.

High-yield stocks often entice investors with the prospect of substantial revenue growth and dividends. Yet, they can also lead to substantial losses if the risks aren’t managed properly.

Company-Specific Risks

Every company has inherent risks, whether they’re financial, legal, or operational. Diving deep into a company’s fundamentals, such as their earnings reports, debt levels, and industry position, helps us identify these risks.

We always aim to differentiate between companies where the perceived risk is higher than the actual risk to capitalize on market misjudgments.

Company-Specific Risk Strategy: A company facing temporary challenges that do not fundamentally impair its long-term prospects can be a source of above-average yields if its revenue growth is reliable and sustainable.

Utilizing Funds and ETFs

When seeking to enhance our investment portfolio, using funds such as mutual funds and ETFs (exchange-traded funds), can provide diverse exposure to the stock market. Each instrument has distinct characteristics and cost structures that are imperative to consider.

Comparing Mutual Funds to ETFs

Mutual funds are managed by professional investors who allocate the funds’ assets with the intention of meeting a specific investment objective.

Unlike ETFs, mutual funds are typically actively managed, which can result in higher fees due to the costs associated with ongoing portfolio management.

Moreover, mutual funds often require a minimum investment amount, making them less accessible for smaller investors.

On the other hand, ETFs trade like stocks throughout the trading day, often with lower expense ratios due to their passive management strategy. This means they usually aim to replicate the performance of a specific index rather than outperform the market.

This can be advantageous for us as investors looking for a cost-effective and straightforward approach to diversifying our portfolio.

Index Funds and Expense Ratio

In the context of passive investment strategies, index funds are a popular choice. These funds are designed to mirror the performance of a specific index, such as the S&P 500. An index fund can be structured as a mutual fund or as an ETF.

A critical factor we must always consider is the expense ratio. This is the annual fee expressed as a percentage of an investment’s average assets. Index funds typically offer lower expense ratios since they are passively managed.

This reduces the operational costs and the drag on our returns over time compared to more actively managed funds.

Covered Call Strategies

Within the realm of ETFs, certain strategies like covered call strategies can be employed to generate income. A covered call ETF will hold the stocks in the index and then sell call options on those stocks to produce additional income.

This income can offset declines in the stock’s price but may also limit the upside potential if the stock price rises significantly.

From our experience, utilizing covered call strategies through ETFs has been beneficial for clients seeking steady income while maintaining a foothold in the stock market. However, it’s essential to understand that this approach typically trades off significant capital appreciation for a more stable income stream.

By carefully choosing between mutual funds, ETFs, index funds, and considering the expense ratio and strategies such as covered calls, we can optimize our portfolio to align with our investment goals and risk tolerance.

Industry Expert Insights

When looking at high yield stock strategies, it’s imperative to consider authoritative expert analysis and concrete financial figures, such as revenue growth rate and return on capital, which can guide our investment decisions.

Analyst Reports and Forecasts

Analysts play a crucial role in shaping our expectations and strategies around high-yield stocks.

They dive into the performance data of companies, issuing reports that assess the prospects of stocks on various parameters, including the return on capital.

For instance, a high return on capital often indicates that a company is capable of generating a superior yield for its investors, a detail analysts won’t overlook in their forecasts.

- Analyst Report: ABC Capital

- Return on Capital: 8%

- Forecast Summary: Bullish on Tech and Healthcare sectors

We give weight to these insights because they are based on rigorous analysis of market trends, sector dynamics, and individual company performance.

Their forecasts impact our stock selection and portfolio strategy, guiding us towards sectors and companies with a solid track record and promising prospects.

Revenue and Earnings Growth

Understanding a company’s revenue growth rate is central to identifying high-yield opportunities. A consistent and upward revenue trend can be a strong indicator of a company’s capacity to maintain or increase its dividends.

We meticulously examine the historical and projected earnings growth, as these figures provide us with an insight into the financial health and potential for future yield.

- Company XYZ Inc.

- Revenue Growth (5-Year Avg.): 6%

- Projected Earnings Growth: 9%

We recall an instance where a tech firm we had been monitoring demonstrated a strong revenue growth rate quarter over quarter. This was a signal for us to dig deeper into the fundamentals, eventually recognizing the dividends were not only sustainable but likely to increase.

These are the cold, hard numbers we rely on to discern whether a high yield is truly a sign of strength or a red flag for a company stretching itself too thin.

It’s a balance of quantitative analysis and strategic foresight that positions us in a place of confidence and assurance as we advise on high-yield stock investments.

Maximizing Portfolio Returns

Maximizing portfolio returns is a critical goal for investors. In our pursuit of wealth growth, understanding and utilizing high-yield stock strategies can result in enhanced passive income and potentially lower portfolio volatility. Let’s explore specific tactics to bolster returns.

Dividend Aristocrats and Stability

Dividend Aristocrats are a select group of companies with a history of providing increasing dividends for at least 25 consecutive years.

This hallmark of consistency suggests a certain financial robustness. Our clients often view these stocks as foundational elements in their portfolios due to their resilience during market fluctuations.

A well-chosen Dividend Aristocrat can serve as a stabilizing force, contributing to a balance between capital gains and steady income.

Forward Dividend Yield

When evaluating potential high-yield stock opportunities, we always consider the Forward Dividend Yield. This yield, expressed as a percentage, is a projection of the dividends a company is expected to pay out over the next year relative to its stock price. It’s an informative metric to gauge future passive income.

A higher Forward Dividend Yield can be attractive, but it’s important to analyze the sustainability of such payouts to ensure they’re not jeopardizing the long-term prospects of the company.

Passive Income Strategies

Our aim is to construct an investment portfolio that works as hard as we do. One of the avenues is through passive income strategies, which involve investments that can provide regular income with minimal effort.

Beyond Dividend Aristocrats, we look to include stocks with high current dividend yields and those situated in sectors known for dividend growth. Real Estate Investment Trusts (REITs) and high-yield bonds, when used judiciously, can also bolster passive income.

By focusing on Dividend Aristocrats for stability, considering the Forward Dividend Yield for informed selections, and implementing diversified passive income strategies, we work towards optimizing the investment portfolio for reliable returns.

Remember, in doing so, the key is to find a balance that aligns with your long-term financial objectives and risk tolerance.

International Dividend Stocks

When looking into diversifying our investment portfolio internationally, we focus on high-yielding stocks outside our home country.

This strategy introduces us to opportunities in mature markets such as the United Kingdom and Canada, where we can find companies with stable dividends.

International Dividend Strategy:

- Look for established companies

- Evaluate the economic stability of the country

- Consider currency exchange risks

- Review historical dividend payments

The United Kingdom, for instance, has a history of housing corporations that pay consistent dividends. The FTSE 100, the index of the 100 largest publicly traded companies in the UK, is known for its high dividend yield relative to other global indices.

For those who hold shares in Altria Group or Verizon Communications, exploring similar sectors internationally can be a wise move. Telecom giants and consumer goods firms in countries like Canada often offer attractive dividends, making them compelling for those seeking income from their investments.

Canada, with its strong financial sector, offers a variety of high-yielding stocks. The TSX 60 index allows us to tap into these companies, diversified across several industries. Currency exchange rates, however, must be considered as they can impact the effective yield from our perspective.

Example Stocks:

- High-yielding telecoms

- Consumer staples giants

- Financial sector leaders

It is vital to look beyond the yield; we shouldn’t be swayed just because a stock offers a high dividend.

In my experience, the most sustainable dividends come from companies that have a strong balance sheet and a consistent track record of profitability.

To sum things up, international dividend stocks can enhance and diversify our income streams, but they require diligent research to ensure that we’re not exposing ourselves to undue risk. We need to understand the underlying business, the stability of the dividend, and t

he economic context of the region we’re investing in.

Brokerage and Financial Services

Investing in stocks from the brokerage and financial services sector can add considerable value to our investment portfolio, mainly due to their potential for high yields. Brokerage firms play a vital role in our financial markets by providing liquidity and access to various investment products.

When we consider the financials of these firms, we look at their ability to maintain a strong balance sheet and generate revenue through trading fees, management fees, and interest on client cash balances.

Liquidity is another critical factor, as it allows us to enter and exit positions with minimal impact on the market price. High liquidity in stocks means we can act swiftly on market opportunities without the disadvantage of price slippage.

Here are fundamental aspects to focus on:

- Brokerage Firms: Look for firms with a robust client base and diversified service offerings.

- Financials: Analyze key metrics such as return on equity (ROE), profit margins, and earnings growth.

- Liquidity: Ensure the stocks you’re interested in have high trading volumes and low bid-ask spreads.

| Key Metric | Why It Matters |

|---|---|

| ROE | Measures profitability and financial efficiency |

| Margins | Indicates management’s effectiveness |

| Earnings Growth | Suggests potential for future expansion |

| Trading Volume | Reflects the liquidity of the stock |

In my years as a financial advisor, one golden rule has always stood out: always assess the economic moat of the brokerage firm.

These entities need to withstand market volatility while offering innovative services that keep them ahead of the competition. A well-positioned firm with a unique advantage reflected in their financials is more likely to offer stable, high yields over time.

High Yield and Liquidity Considerations

When we’re looking at high yield investments, it’s crucial to weigh both the potential returns and the liquidity of our assets. High yield investments, such as certain stocks with substantial dividend rates, can offer attractive income streams.

Nonetheless, we must be mindful of how quickly we can convert these investments into cash without significantly affecting their value.

Earnings Yield emerges as an important metric when considering high yield stocks. A high earnings yield can indicate that a stock is undervalued, presenting us a dual opportunity for income and capital appreciation. Investors may find merit in high earnings yield stocks heading into 2024.

In our portfolios, liquidity preference varies according to individual circumstances. Here’s a simple breakdown:

- High Liquidity Needs: If we anticipate needing access to our funds within a short period, gravitating towards investments that can be easily sold in the market is prudent. Money market funds or certain high-grade bonds may serve us well in such cases.

- Lower Liquidity Needs: For those of us with a longer investment horizon, we might entertain the luxury of locking in funds for higher yields found in dividend stocks or high yield bonds.

In my experience—and I’ve seen this hold true time and time again—our clients who could afford to be patient with less liquid investments often reaped larger rewards.

Finally, we should always balance our high yield investments with well-considered liquidity strategies to ensure we’re not caught off-guard by unexpected financial needs.

By constructing a balanced and diverse portfolio, we position ourselves to take advantage of high yield opportunities while maintaining the flexibility our financial lives may require.

Key Performance Indicators for Stock Evaluation

When we talk about high yield stock strategies, the pivotal element lies in evaluating and selecting the best performing stocks.

It’s essential we focus on key performance indicators (KPIs) that provide deep insights into a company’s financial health and its potential to provide strong returns. Here are some crucial KPIs to consider:

- Earnings Per Share (EPS): Indicates profitability. A consistently increasing EPS is a sign of a company’s growth and its ability to increase dividends over time.

- Dividend Yield: Measures the cash dividends per share relative to the market price of the stock. It is an important indicator for income-seeking investors.

- Price-to-Earnings (P/E) Ratio: Offers a snapshot of investor sentiment. A lower P/E might suggest a stock is undervalued, though context is key.

We might also look at:

- Debt-to-Equity Ratio: To understand financial leverage and risk.

- Return on Equity (ROE): To assess management’s effectiveness in generating profit with shareholders’ investments.

In my years of advising, I’ve seen ROE serve as a reality check for many over-enthusiastic investors tempted by high yields.

Remember, our strategy must always be backed by solid data analysis and an understanding of these indicators in the context of the broader market. By keeping our eye on these KPIs, we can make informed decisions to position our portfolio for potential success.

Comparative Analysis of Dividend Yields in Various Sectors

When we look at dividend yields across different sectors, we find a variety of opportunities for income-focused investors.

The consumer goods sector has an average yield slightly higher than the overall market. For example, within the consumer goods sector, the cigarette industry stands out with particularly high yields.

In contrast, sectors like technology typically offer lower dividend yields, as these companies often reinvest their earnings into growth and development.

However, it can be a trade-off, as lower yield sectors might offer greater capital appreciation potential.

| Sector | Average Dividend Yield |

|---|---|

| Consumer Goods | ~2.5% |

| Technology | ~1.2% |

| Utilities | ~3.5% |

| Healthcare | ~1.8% |

Utilities are traditionally seen as a strong sector for dividends, with generally stable and predictable cash flows.

The healthcare sector, while having a moderate average dividend yield, can be considered safer in times of economic turbulence due to the essential nature of its services.

In our experience, we’ve found the utilities sector to be quite resilient in market downturns, offering our clients a sense of security with their steady dividend payouts.

By analyzing sectors individually, we gain a clearer understanding of where higher yields might be found, and what trade-offs may come with those yields.

Keep in mind that high yield doesn’t always mean high reward; yields can be inflated due to falling stock prices, which might indicate an underlying issue with the company.